ANALYSIS STOCK TRENDS

By

Robert D. Edwards

and

John Magee

The Dow Theory

At this point, the reader, if he has little previous knowledge of

the stock market, may be suffering a mild attack of mental indigestion.

The Dow Theory is a pretty big dose to swallow at one

sitting.

the stock market, may be suffering a mild attack of mental indigestion.

The Dow Theory is a pretty big dose to swallow at one

sitting.

We departed deliberately in the foregoing chapter from the

order in which its principles are usually stated, in an effort to make

it a little easier to follow and understand. Actually, not all of the

twelve tenets we named are of equal import.

order in which its principles are usually stated, in an effort to make

it a little easier to follow and understand. Actually, not all of the

twelve tenets we named are of equal import.

The essential rules are

contained in 2, 3,4, 5, 8,10 and 11. Number 1 is, of course, the basic

assumption, the philosophical justification for these rules. The

other points (6, 7, 9, and 12) furnish "background material," as the

news reporters might put it, which aid in interpretation. Theoretically,

one should, by strict adherence to the essential rules alone,

accomplish just as much as he could with the added collateral

evidence.

contained in 2, 3,4, 5, 8,10 and 11. Number 1 is, of course, the basic

assumption, the philosophical justification for these rules. The

other points (6, 7, 9, and 12) furnish "background material," as the

news reporters might put it, which aid in interpretation. Theoretically,

one should, by strict adherence to the essential rules alone,

accomplish just as much as he could with the added collateral

evidence.

But the utilization of Dow Theory is, after all, a matter of interpretation.

You may memorize its principles verbatim and yet be

confounded when you attempt to apply them to an actual market

situation.

You may memorize its principles verbatim and yet be

confounded when you attempt to apply them to an actual market

situation.

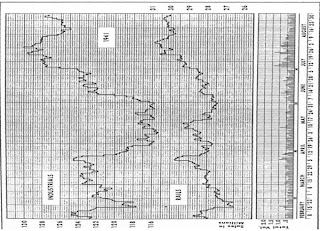

We can better organize our knowledge of the Theory and

acquire some understanding of its interpretation by following

through a few years of market action and seeing how it looked at

the time through the eyes of a Dow Theorist. For this purpose, we

may well take the period from late 1941 to the beginning of 1947,

since this covers the end of one Bear Market, an entire long Bull

Market and part of another Bear Market, and includes examples of

most of the market phenomena with which the Dow Theory has to

deal.

acquire some understanding of its interpretation by following

through a few years of market action and seeing how it looked at

the time through the eyes of a Dow Theorist. For this purpose, we

may well take the period from late 1941 to the beginning of 1947,

since this covers the end of one Bear Market, an entire long Bull

Market and part of another Bear Market, and includes examples of

most of the market phenomena with which the Dow Theory has to

deal.

the wishful thinkers again talked Bull Market. There is an unfortunately

tendency in "the street" to overstress any such divergence,

particularly when it can be twisted into a favorable sign.

The fact is that, in Dow Theory, the refusal of one average to confirm

the other can never produce a positive signal of any sort. It has

only negative connotations.

tendency in "the street" to overstress any such divergence,

particularly when it can be twisted into a favorable sign.

The fact is that, in Dow Theory, the refusal of one average to confirm

the other can never produce a positive signal of any sort. It has

only negative connotations.

Divergences sometimes occur at reversals

in the Major trend—there have been several instances in

market history of which perhaps the most remarkable occurred

way back in 1901 and 1902, and we shall soon inspect another—

but they also occur with at least equal frequency at times when no

Major reversal is developing, and the instance we are here discussing

was one of the latter.

in the Major trend—there have been several instances in

market history of which perhaps the most remarkable occurred

way back in 1901 and 1902, and we shall soon inspect another—

but they also occur with at least equal frequency at times when no

Major reversal is developing, and the instance we are here discussing

was one of the latter.

So the situation at the end of May in 1941 was precisely the

same to the Dow Theorist, insofar as the Major trend was concerned,

as it had been on February 14. The June-July rally topped

out in the Rails at 30.88 on August 1, and in the Industrials at

130.06 on July 28 (compare these figures with their 1940 November

highs) and prices then declined at an accelerating pace which culminated,

temporarily, in the "Pearl Harbor" panic. This took the

Industrial average below its previous Bear Market low (111.84 on

June 10, 1940), although the Rails again did not follow. They had,

however, by this time broken below their previous (February 14)

Intermediate bottom by a liberal margin.

same to the Dow Theorist, insofar as the Major trend was concerned,

as it had been on February 14. The June-July rally topped

out in the Rails at 30.88 on August 1, and in the Industrials at

130.06 on July 28 (compare these figures with their 1940 November

highs) and prices then declined at an accelerating pace which culminated,

temporarily, in the "Pearl Harbor" panic. This took the

Industrial average below its previous Bear Market low (111.84 on

June 10, 1940), although the Rails again did not follow. They had,

however, by this time broken below their previous (February 14)

Intermediate bottom by a liberal margin.

The next period of importance began in April, 1942. We can

skip any detailed chart of the months between December and

April because they posed no Dow Theory problems. After a Minor

rally in the Rails in January, prices simply drifted lower and lower,

but it was increasingly evident that trading volume did not expand

on the dips (minor declines).

skip any detailed chart of the months between December and

April because they posed no Dow Theory problems. After a Minor

rally in the Rails in January, prices simply drifted lower and lower,

but it was increasingly evident that trading volume did not expand

on the dips (minor declines).

Liquidation was drying up; the

boardrooms were void of customers; the atmosphere was typical

of the last stages of a Bear Market.

boardrooms were void of customers; the atmosphere was typical

of the last stages of a Bear Market.

developed, when, after rallying for only seven days, the Railroad

index began to slip off while the other average kept right on going

up. Trading activity remained at a low ebb (there was no sustained

volume increase, in fact, until late September).

index began to slip off while the other average kept right on going

up. Trading activity remained at a low ebb (there was no sustained

volume increase, in fact, until late September).

On June 1, the Rails

dropped to another new low and on the 2nd closed at 23.31. On

June 22, it looked as though the Industrials were going to be

pulled down again, but only a few days later, the best rally in

months got started, taking the Industrials to new highs and more

than recovering all of the April-May loss in the Rails. Activity also

speeded up briefly, with one day registering a greater turnover

than the market had enjoyed in any session since early January.

Signs of Major Turn

dropped to another new low and on the 2nd closed at 23.31. On

June 22, it looked as though the Industrials were going to be

pulled down again, but only a few days later, the best rally in

months got started, taking the Industrials to new highs and more

than recovering all of the April-May loss in the Rails. Activity also

speeded up briefly, with one day registering a greater turnover

than the market had enjoyed in any session since early January.

Signs of Major Turn

Again the Dow Theorists were very much on the alert. An advance

of Intermediate proportions was obviously under way. Until

proved otherwise, it had to be labeled a Secondary within the Bear

Market which was still presumably in effect, but that Major

downtrend had by now run for nearly three years—nearly as long

as any on record—and its last decline had shown no selling pressure

whatever, simply a dull drift. This presumed Secondary

might turn out to be, instead, a new Primary; hopes for such a

denouement had been blighted twelve months earlier under somewhat

similar circumstances, but this time prices were lower and

there was a different "feel" to the market. The general news offered

little encouragement, but the Dow Theory does not concern

itself with any news other than that made by the market itself

(which discounts all other kinds of news).

In any event, there was

nothing to do but wait and see—let the market, in its own time

and way, state its own case.

nothing to do but wait and see—let the market, in its own time

and way, state its own case.

It was necessary now to relabel the up move from April-June

to November of 1942 as the first Primary swing in a Bull Market.

The decline of the Rails from November 2 to December 14 was

now recognized as the first Secondary within that Major trend.

We may turn back for a moment at this point to comment on

the performance of the Rail index in June, 1942. Because it held

then above its low of May, 1940, some commentators have maintained

that the Bull Market should really have been dated from

that former year as representing the last "confirmed" lows. This

strikes us as rather impractical hair-splitting. Regardless of the 1.17

higher level in the Rail average in June, 1942, a genuine Bull move

did not start until that time.

to November of 1942 as the first Primary swing in a Bull Market.

The decline of the Rails from November 2 to December 14 was

now recognized as the first Secondary within that Major trend.

We may turn back for a moment at this point to comment on

the performance of the Rail index in June, 1942. Because it held

then above its low of May, 1940, some commentators have maintained

that the Bull Market should really have been dated from

that former year as representing the last "confirmed" lows. This

strikes us as rather impractical hair-splitting. Regardless of the 1.17

higher level in the Rail average in June, 1942, a genuine Bull move

did not start until that time.

We suspect that before many years

have passed, Dow Theorists will have occasion greatly to regret

the importance which has since been assigned to the Rails' "failure

to confirm" in the spring of 1942.

have passed, Dow Theorists will have occasion greatly to regret

the importance which has since been assigned to the Rails' "failure

to confirm" in the spring of 1942.

Remember, such a divergence

does not and cannot produce a positive signal; at the time of its occurrence,

it can serve merely to negative or cast in doubt the implications

of the other average; only subsequent action in the opposite

direction can establish the existence of a change in trend. If

the Rails' decline in May, 1942 had carried them below 22.14, but

their subsequent action had followed the course which it actually

did, point for point but at a lower level, a Bull Market signal

would nevertheless have been given at the very same time, not one

later and not one day sooner.

does not and cannot produce a positive signal; at the time of its occurrence,

it can serve merely to negative or cast in doubt the implications

of the other average; only subsequent action in the opposite

direction can establish the existence of a change in trend. If

the Rails' decline in May, 1942 had carried them below 22.14, but

their subsequent action had followed the course which it actually

did, point for point but at a lower level, a Bull Market signal

would nevertheless have been given at the very same time, not one

later and not one day sooner.

Moreover, a divergence does not necessarily imply that a move

of consequence in the opposite direction will ensue. We have already

examined one comparable instance (in the spring of 1941)

which resulted otherwise.

of consequence in the opposite direction will ensue. We have already

examined one comparable instance (in the spring of 1941)

which resulted otherwise.

Logically, also, if a failure to confirm

such as occurred in 1942 is to be taken as an indication of a turn in

trend, then its opposite, i.e., confirmation or reaffirmation by both

averages, should argue with equal force against a turn in trend. Yet

the simple truth is that many more Major reversals have come

when the averages were in agreement than when they were divergent.

We have no wish to belabor the point or waste the reader's

time but we do feel that he should be warned against the wishful

thinking which every "failure to confirm" seems to inspire when

the market is in a Bear trend.

such as occurred in 1942 is to be taken as an indication of a turn in

trend, then its opposite, i.e., confirmation or reaffirmation by both

averages, should argue with equal force against a turn in trend. Yet

the simple truth is that many more Major reversals have come

when the averages were in agreement than when they were divergent.

We have no wish to belabor the point or waste the reader's

time but we do feel that he should be warned against the wishful

thinking which every "failure to confirm" seems to inspire when

the market is in a Bear trend.

To return to our history, the averages closed at 125.88 and

29.51, respectively, on the day following our conclusive Bull

Market signal in February, 1943. Theoretically, there is where an

investor who followed the Dow Theory strictly would have

bought his stocks. (Those who were satisfied that the Primary

trend was up in November, 1942, bought with averages around

114.60 and 29.20.) It was reasonable to assume that this Bull

Market, which as yet showed few of the usual characteristics of the

second phase and none whatever of the third phase, would continue

for some time to come. The next four months produced no

market developments that required interpretative attention, and

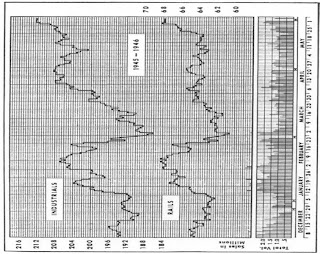

we can move on to the events of July. Figure 6 charts the action

from July 1,1943 to January 31,1944.

The First Correction

After closing at 145.82 on July 14, 1943, the Industrial average

drifted off. The Rails pushed up to a new high (38.30) ten days

later, but the Industrials refused to join in the rally and then both

indexes cracked down sharply for seven sessions. Turnover increased

and the decline was the greatest that had occurred in the

Bull Market up to that date, but everyone realized that the market,

after several months of quite persistent advance,

drifted off. The Rails pushed up to a new high (38.30) ten days

later, but the Industrials refused to join in the rally and then both

indexes cracked down sharply for seven sessions. Turnover increased

and the decline was the greatest that had occurred in the

Bull Market up to that date, but everyone realized that the market,

after several months of quite persistent advance,

Bull Trend Reaffirmed

The situation remained in doubt (but subject always to that

basic presumption of the Dow Theory which we named as Number

12 in the preceding chapter) until June 15, 1944, when the Industrials

finally came through to close at 145.86. It had taken them

four months to confirm the Rails, almost a full year to reaffirm the

Primary uptrend. The effect of this "signal" on traders was electric;

trading volume increased by 650,000 shares on the following day

as prices jumped another full point.

The situation remained in doubt (but subject always to that

basic presumption of the Dow Theory which we named as Number

12 in the preceding chapter) until June 15, 1944, when the Industrials

finally came through to close at 145.86. It had taken them

four months to confirm the Rails, almost a full year to reaffirm the

Primary uptrend. The effect of this "signal" on traders was electric;

trading volume increased by 650,000 shares on the following day

as prices jumped another full point.

The following twelve months need no detailed discussion as

they produced nothing in the way of market action to give a Dow

Theorist any concern. Prices drifted off irregularly for nine weeks

after mid-July but their net loss was of minor proportions, and

they then climbed with only brief interruptions to 169.08 in the Industrial

index on May 29,1945 and 63.06 in the Rail index on June

26,1945. We should take a brief look at the period which followed,

not because it illustrates anything new in our study, but because it

takes in the surrender of Japan and the end of fighting in World

War II.

they produced nothing in the way of market action to give a Dow

Theorist any concern. Prices drifted off irregularly for nine weeks

after mid-July but their net loss was of minor proportions, and

they then climbed with only brief interruptions to 169.08 in the Industrial

index on May 29,1945 and 63.06 in the Rail index on June

26,1945. We should take a brief look at the period which followed,

not because it illustrates anything new in our study, but because it

takes in the surrender of Japan and the end of fighting in World

War II.

Figure 7 covers the seven months from May 1 to November 30,

1945. The Industrials held steady for four weeks while the Rails

were making the spurt to their June 26 top.

1945. The Industrials held steady for four weeks while the Rails

were making the spurt to their June 26 top.

On June 28, with nothing

in the newspaper headlines to account for such a radical trend

change, prices broke sharply and turnover climbed to nearly three

million shares, the highest day's total for the Bull Market up to

that time. But the Industrial average gave ground reluctantly

thereafter, and by June 26, at 160.91, had given up less than 5% of

its top price. The Rails shook down rapidly, however.

in the newspaper headlines to account for such a radical trend

change, prices broke sharply and turnover climbed to nearly three

million shares, the highest day's total for the Bull Market up to

that time. But the Industrial average gave ground reluctantly

thereafter, and by June 26, at 160.91, had given up less than 5% of

its top price. The Rails shook down rapidly, however.

The Rails Falter

Before we go on with our examination of the market action

here, it is interesting to note that, up to this point, the Rail average

had been the "hero" of our story. Starting with its refusal to go

down to a new Bear Market low in June of 1942, it was the spearhead

of each important advance, had staged the most spectacular

rallies, had gained 170% in value as compared with the Industrials'

82%. In retrospect, the explanation is obvious: The railroads were

the chief business beneficiaries of the war. They were rolling up

profits, paying off indebtedness and reducing their fixed charges

at a rate unheard of in this generation (and probably never to be

seen again). While the "public's" eye was on the traditional and

better publicized "war industries," the market began as far back as

Pearl Harbor shrewdly to appraise and discount this unprecedented

harvest for the Rails. But from here on, the picture changes

and the Rails become the laggards. As we look back now, it is just

as obvious that, with equal shrewdness, the market began in July

of 1945 to discount a change in their fortunes. An illuminating

demonstration of the basic assumption (Tenet Number 1) in Dow

Theory!

Before we go on with our examination of the market action

here, it is interesting to note that, up to this point, the Rail average

had been the "hero" of our story. Starting with its refusal to go

down to a new Bear Market low in June of 1942, it was the spearhead

of each important advance, had staged the most spectacular

rallies, had gained 170% in value as compared with the Industrials'

82%. In retrospect, the explanation is obvious: The railroads were

the chief business beneficiaries of the war. They were rolling up

profits, paying off indebtedness and reducing their fixed charges

at a rate unheard of in this generation (and probably never to be

seen again). While the "public's" eye was on the traditional and

better publicized "war industries," the market began as far back as

Pearl Harbor shrewdly to appraise and discount this unprecedented

harvest for the Rails. But from here on, the picture changes

and the Rails become the laggards. As we look back now, it is just

as obvious that, with equal shrewdness, the market began in July

of 1945 to discount a change in their fortunes. An illuminating

demonstration of the basic assumption (Tenet Number 1) in Dow

Theory!

Turning back to our chart, prices began to push up again with

renewed vigor after August 20. Both averages had experienced a

Secondary reaction and now Dow Theorists had to watch closely

to see if the Primary uptrend would again be reaffirmed by their

going to new highs.

The Industrials "made the grade" when they

closed at 169.89 on August 24, but the Rails had much more

ground to recover and were running into offerings as they came

up in succession to each of the Minor bottom levels of their June-

August downtrend (a phenomenon to which we shall devote some

attention later on in the chapter on "Support and Resistance").

closed at 169.89 on August 24, but the Rails had much more

ground to recover and were running into offerings as they came

up in succession to each of the Minor bottom levels of their June-

August downtrend (a phenomenon to which we shall devote some

attention later on in the chapter on "Support and Resistance").

The Spring of 1946

The market went through a minor setback in late December—a

development which has come to be expected as the normal pattern

for that month and which is usually attributed to "tax selling"—

and stormed ahead again in January, 1946. Daily volume on

January 18 exceeded three million shares for the first time in more

than five years. During the first week of February, prices

"churned" with little net change. Extreme high closes were

registered during this period by the Rail average at 68.23 on

February 5, and by the Industrial average at 206.97 on February 2.

On February 9,

the 13th to the 16th, and then broke in a selling wave that ran to a

climax on February 26 with closings at 60.53 and 186.02, respectively.

The loss in the Industrials was the greatest in points (20.95)

they had suffered during the entire Bull Market; in the Rails, it was

exceeded only by their July-August decline of the previous year. It

amounted to a little more than 10% in the former and 11% in the

latter, and gave up a little less than half of their advances from the

1945 summer lows. The decline was three weeks old on February

26. It was an unqualified Intermediate—in Dow Theory a Secondary

reaction presumptively within the still existing Major

uptrend.

climax on February 26 with closings at 60.53 and 186.02, respectively.

The loss in the Industrials was the greatest in points (20.95)

they had suffered during the entire Bull Market; in the Rails, it was

exceeded only by their July-August decline of the previous year. It

amounted to a little more than 10% in the former and 11% in the

latter, and gave up a little less than half of their advances from the

1945 summer lows. The decline was three weeks old on February

26. It was an unqualified Intermediate—in Dow Theory a Secondary

reaction presumptively within the still existing Major

uptrend.

Labor troubles were dogging the steel and motor industries in

1946 from early January on, and a coal strike was looming. The

February break was attributed to those news developments, but

the ruling cause was more likely the discontinuance of margin

trading. The Federal Reserve Board had announced in January that

after February 1, stocks could be bought only for full 100% cash.

The late January up-fling was featured by the "little fellow" seizing

his last chance to buy on margin. (Those who participated in

this scramble will doubtless regret it for a long time yet to come.)

Professionals seized the opportunity to unload their trading commitments,

but the "little fellow" was now temporarily out of

funds; his brokerage account was quickly "frozen." Under the circumstances,

as we look back, it is amazing that a more extensive

panic did not then eventuate.

1946 from early January on, and a coal strike was looming. The

February break was attributed to those news developments, but

the ruling cause was more likely the discontinuance of margin

trading. The Federal Reserve Board had announced in January that

after February 1, stocks could be bought only for full 100% cash.

The late January up-fling was featured by the "little fellow" seizing

his last chance to buy on margin. (Those who participated in

this scramble will doubtless regret it for a long time yet to come.)

Professionals seized the opportunity to unload their trading commitments,

but the "little fellow" was now temporarily out of

funds; his brokerage account was quickly "frozen." Under the circumstances,

as we look back, it is amazing that a more extensive

panic did not then eventuate.

But the Dow Theorist was not concerned with causes. The Bull

Market had been reaffirmed by both averages in early February,

canceling all previous "signal" levels. Bullish forces were still evidently

in effect because the February 26 lows held and prices

began to recover.

Market had been reaffirmed by both averages in early February,

canceling all previous "signal" levels. Bullish forces were still evidently

in effect because the February 26 lows held and prices

began to recover.

The Industrials came back quickly, and by April

9 had closed in new high ground at 208.03. The Rails dragged.

When the market showed signs of weakening at the end of April,

the Rail average was still nearly 5 points below its early February

high. Was this another "failure to confirm" to worry about?

9 had closed in new high ground at 208.03. The Rails dragged.

When the market showed signs of weakening at the end of April,

the Rail average was still nearly 5 points below its early February

high. Was this another "failure to confirm" to worry about?

Final Up Thrust

The late February bottoms were now the critical points on the

downside; if both averages should decline below the Intermediate

low closes then recorded, before the Rails could make a new high

above 68.23 (in which event the bullish signal of the Industrials

would be canceled),

The late February bottoms were now the critical points on the

downside; if both averages should decline below the Intermediate

low closes then recorded, before the Rails could make a new high

above 68.23 (in which event the bullish signal of the Industrials

would be canceled),

a Bear Market would thereby be signaled. But,

despite a miner's strike and an imminent rail workers' strike, the

market turned firm again in mid-May and put forth a surprising

rally which swept the Industrial index up to 212.50 on May 29,

1946—a new Bull high by nearly 6 points. The Rails failed in May

by only .17 to equal their February high close, slid back a trifle and

then pushed through at last on June 13 to close at 68.31, thereby

confirming the Industrials in their announcement that (as of that

date) the Primary trend was still Up. The February lows (186.02

and 60.53) now ceased to signify in Dow Theory, but keep those

figures in mind because they are involved in an argument which

raged among Dow students for months thereafter.

despite a miner's strike and an imminent rail workers' strike, the

market turned firm again in mid-May and put forth a surprising

rally which swept the Industrial index up to 212.50 on May 29,

1946—a new Bull high by nearly 6 points. The Rails failed in May

by only .17 to equal their February high close, slid back a trifle and

then pushed through at last on June 13 to close at 68.31, thereby

confirming the Industrials in their announcement that (as of that

date) the Primary trend was still Up. The February lows (186.02

and 60.53) now ceased to signify in Dow Theory, but keep those

figures in mind because they are involved in an argument which

raged among Dow students for months thereafter.

Figure 9 overlaps the preceding picture, taking up the market's

action on May 4 and carrying it forward to October 19,1946. Trading

volume, it may be noted, in late May and early June did not

come up to the levels of either the late January to early February

top or the late February bottom; the market appeared to be losing

vitality, an ominous, although by no means, decisive manifestation.

Prices began to fall off rapidly immediately after the Rail confirmation

on June 13. The Industrials rallied for two weeks in early

July, but the Rails continued to decline; the Industrials broke again

on July 15 and the two averages continued their slide until they

stood at 195.22 and 60.41 at the close on July 23.

action on May 4 and carrying it forward to October 19,1946. Trading

volume, it may be noted, in late May and early June did not

come up to the levels of either the late January to early February

top or the late February bottom; the market appeared to be losing

vitality, an ominous, although by no means, decisive manifestation.

Prices began to fall off rapidly immediately after the Rail confirmation

on June 13. The Industrials rallied for two weeks in early

July, but the Rails continued to decline; the Industrials broke again

on July 15 and the two averages continued their slide until they

stood at 195.22 and 60.41 at the close on July 23.

There, as it subsequently developed, was the end of that particular

Intermediate swing—one which in accord with our Rule 12

had to be labeled a Secondary reaction in a Bull Market until

proved otherwise. The market swung up again. It climbed slowly

and steadily, but with turnover running well under a million

shares, until exactly three weeks later

Intermediate swing—one which in accord with our Rule 12

had to be labeled a Secondary reaction in a Bull Market until

proved otherwise. The market swung up again. It climbed slowly

and steadily, but with turnover running well under a million

shares, until exactly three weeks later

The Bear Market Signal

That the situation was critical was evident in the volume chart.

Ever since the end of May, turnover had tended not only to increase

on the declines but, what was much more important, to dry

up on the rallies. Compare Figure 9 with 7 and 8, and you can see

how conspicuous this phenomenon had become by mid-August.

Prices did turn down, with activity increasing on the breaks, and

on August 27, the closing prices—191.04 for the Industrials and

58.04 for the Rails—told a sad story. The averages had spoken: a

four-year Bull Market had ended, and a Bear Market was under

way. A Dow investor should have sold all his stocks on the following

day (at approximately 190 and 58 in terms of the two

averages).

That the situation was critical was evident in the volume chart.

Ever since the end of May, turnover had tended not only to increase

on the declines but, what was much more important, to dry

up on the rallies. Compare Figure 9 with 7 and 8, and you can see

how conspicuous this phenomenon had become by mid-August.

Prices did turn down, with activity increasing on the breaks, and

on August 27, the closing prices—191.04 for the Industrials and

58.04 for the Rails—told a sad story. The averages had spoken: a

four-year Bull Market had ended, and a Bear Market was under

way. A Dow investor should have sold all his stocks on the following

day (at approximately 190 and 58 in terms of the two

averages).

To clear the record, it was necessary for the Dow Theorist now

to go back and mark the May 29 and June 13 highs in the Industrials

and Rails, respectively, as the end of the Bull Market. The

June-July decline then became the first Primary swing in the new

Bear trend, and the July 23 to August 14 advance became the first

Secondary recovery within the Major downtrend.

to go back and mark the May 29 and June 13 highs in the Industrials

and Rails, respectively, as the end of the Bull Market. The

June-July decline then became the first Primary swing in the new

Bear trend, and the July 23 to August 14 advance became the first

Secondary recovery within the Major downtrend.

A second

Primary swing was now in process of development.

You will have noted in the foregoing that a Bear Market was

signaled as soon as both averages penetrated their July 23 lows.

Lot us return now and take up that argument which we mentioned

on the preceding page. Some students of Dow Theory refused to

recognize the new high of June 13 in the Rail average as a decisive

reaffirmation of the Bull trend. The previous close should be bettered

by at least a full point (1.00), many argued

Primary swing was now in process of development.

You will have noted in the foregoing that a Bear Market was

signaled as soon as both averages penetrated their July 23 lows.

Lot us return now and take up that argument which we mentioned

on the preceding page. Some students of Dow Theory refused to

recognize the new high of June 13 in the Rail average as a decisive

reaffirmation of the Bull trend. The previous close should be bettered

by at least a full point (1.00), many argued

The market did, of course, proceed to break its February lows,

and by that time, the panic (second phase) was on. Obviously, in

this case, the orthodox "any-penetration-whatever" school had all

the best of it; they had sold out at least 13 points higher up in

terms of the Industrial index (at least 6 in the Rails). Six weeks

later, on October 9, 1946 to be exact, this second Primary Intermediate

swing ended at Industrials 163.12, Rails 44.69, and another

Intermediate recovery move started.

and by that time, the panic (second phase) was on. Obviously, in

this case, the orthodox "any-penetration-whatever" school had all

the best of it; they had sold out at least 13 points higher up in

terms of the Industrial index (at least 6 in the Rails). Six weeks

later, on October 9, 1946 to be exact, this second Primary Intermediate

swing ended at Industrials 163.12, Rails 44.69, and another

Intermediate recovery move started.

Before closing this history of six years of Dow Theory interpretation,

we might note that the June 13 high in the Rail average

furnishes a perfect illustration of the rule that a trend can change

any time after it has been confirmed or reaffirmed, also of the

diminishing odds in favor of continuance with each successive

reaffirmation of the Primary trend.

we might note that the June 13 high in the Rail average

furnishes a perfect illustration of the rule that a trend can change

any time after it has been confirmed or reaffirmed, also of the

diminishing odds in favor of continuance with each successive

reaffirmation of the Primary trend.