Throughout 2011 we were reluctant to increase our exposure to the mining sector and only made one purchase which was back in February 2011. We did produce a number of articles questioning the wisdom of investing in mining stocks as we were of the opinion that they were not performing despite the constant mantra that supports this tiny sector.

السبت، 31 ديسمبر 2011

2011 was a poor year gold stocks

Throughout 2011 we were reluctant to increase our exposure to the mining sector and only made one purchase which was back in February 2011. We did produce a number of articles questioning the wisdom of investing in mining stocks as we were of the opinion that they were not performing despite the constant mantra that supports this tiny sector.

الثلاثاء، 27 ديسمبر 2011

about 2011 summy og gold and selver interest and opportunites for trading

If you're bullish about the long term for gold and silver, it's mouthwatering to watch them undergo a major correction after taking earlier profits that added to your deployable cash. For a little historical perspective on pullbacks, consider the following charts.

The current 15.6% gold decline, while considered a "major" correction, is not out of the ordinary, particularly following the late summer spike. And after each big selloff, there was a price consolidation phase that in every instance led to higher prices. The message: hold on, and buy the big dips.

Not surprisingly, silver's biggest corrections are larger than gold's. This is also true for the rebounds; they've been quite dramatic. If we apply the biggest three-month recovery of 44.3% to the current correction, that would take silver to $40.63… meaning we probably shouldn't expect $60 silver by year-end.

[There's still time to capitalize on the anomaly in the metals market that will bring amazing profits to those who are positioned for it. This report will help you get started… and offers a special bonus, too. Don't delay – the tide could turn very soon.]

Regarding www.skoptionstrading.com. We have just closed another trade which generated a profit of around 23%, however, we had two trades that were not profitable so the profit on our portfolio now stands at 374.43% since inception.

Please be aware that discussions are taking place regarding an increase in the price for this service for new members, so if you are thinking about joining us, then do it sooner rather later in order to save yourself a fair few bucks by avoiding this additional expense.

Our model portfolio is up 374.43% since inception

An annualized return of 94.38%

Average return per trade of 36.57%

92 completed trades, 85 closed at a profit

A success rate of 92.39%

Average trade open for 48.13 days

So, the question is: Are you going to make the decision to join us today?

Also many thanks to those of you who have already joined us and for the very kind words that you sent us regarding the service so far, we hope that we can continue to put a smile on your faces.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge.

The current 15.6% gold decline, while considered a "major" correction, is not out of the ordinary, particularly following the late summer spike. And after each big selloff, there was a price consolidation phase that in every instance led to higher prices. The message: hold on, and buy the big dips.

Not surprisingly, silver's biggest corrections are larger than gold's. This is also true for the rebounds; they've been quite dramatic. If we apply the biggest three-month recovery of 44.3% to the current correction, that would take silver to $40.63… meaning we probably shouldn't expect $60 silver by year-end.

[There's still time to capitalize on the anomaly in the metals market that will bring amazing profits to those who are positioned for it. This report will help you get started… and offers a special bonus, too. Don't delay – the tide could turn very soon.]

Regarding www.skoptionstrading.com. We have just closed another trade which generated a profit of around 23%, however, we had two trades that were not profitable so the profit on our portfolio now stands at 374.43% since inception.

Please be aware that discussions are taking place regarding an increase in the price for this service for new members, so if you are thinking about joining us, then do it sooner rather later in order to save yourself a fair few bucks by avoiding this additional expense.

Our model portfolio is up 374.43% since inception

An annualized return of 94.38%

Average return per trade of 36.57%

92 completed trades, 85 closed at a profit

A success rate of 92.39%

Average trade open for 48.13 days

So, the question is: Are you going to make the decision to join us today?

Also many thanks to those of you who have already joined us and for the very kind words that you sent us regarding the service so far, we hope that we can continue to put a smile on your faces.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge.

US Real Interest Rates Indicate Gold Slightly Undervalued

n this update, we look at the latest trend emerging in US real rates. US real rates continue to fall and as a result we remain bullish on gold.

We have covered the dynamics of the relationship between gold and U.S. real rates before, but for new readers and those wanting a refresher, here’s an excerpt from a previous article:

“Gold investors tend to focus overwhelmingly on the relationship between the US dollar and gold, citing that a lower dollar leads to higher gold prices in US dollars. Whilst this may be generally true, there is another relationship that does not get as much attention as we believe it deserves, and that is the relationship gold has with US real interest rates. For the first few years of this gold bull market, it was sufficient simply to acknowledge the USD down, therefore gold up dynamic, but now things have changed. Over the past couple of years gold has rallied when the greenback has been making gains, as well as when it was weakening, therefore investors must now take note of the inverse relationship between US real interest rates and gold, which has been observed consistently over the last couple of years.

The basic fundamentals behind this inverse relationship are that when US monetary policy is looser, real rates fall and therefore investors buy gold for a number of reasons.

Firstly, lower real rates could imply higher inflationary expectations in the future therefore gold is bought as a hedge against this possible inflation.

Secondly, lower real returns in Treasuries drives investors into risk assets in search of a higher return. This also sends gold higher but it also sends most commodities, risk currencies and equities higher too.

Thirdly, lower real returns on Treasuries reduce demand of US dollars, causing the dollar to fall and therefore the gold price to rise in US dollars.

Finally, looser monetary policy implies that the economic situation is not as rosy as many would like to believe, so if the Federal Reserve acts by loosening monetary policy and driving down real interest rates then that send a message that the economy is in a bad place therefore investors buy gold as a safe haven asset. There are probably many more reasons for this relationship, but we have just tried to cover the main ones.”

We believe the above explanation of U.S. real rates is the key tool for predicting gold movements. Our analysis and subsequent forecasts have been proved correct in the past and our current view is this:

In the past few months we have observed further deterioration in 10 year U.S. real rates to their current level of 0%.

As noted this is a bullish sign for gold. We would expect gold to have risen over this period to about $1800-$1900, but it is currently lagging below $1700/oz. For this reason we currently see gold as slightly undervalued, however not considerably. Any short term weakness will see us adding to our positions.

The situation in Europe looks unlikely to improve in the short to medium term. Economic reform is in the works, but this has a long term focus and will not have any effect on the underlying debt issues currently upon us. Any solution arrived at by the ECB will only buy time; the problems at hand will not be resolved long term. In fact recent ECB comments suggest that there will be no monetary easing in Europe in the short term . Comments by Draghi such as “lending money to the IMF to buy Euro bonds is not compatible with the treaty” and emphasis that the ECB’s primary remit is price stability, indicates that talk of quantitative easing in Europe appears to be off the table in the short term. Therefore, whilst we still view the downside in gold as limited, the upside over the short term is now also looking more contained.

The U.S. economy remains timid and additional deterioration in Europe would not help their plight. Further easing in early 2012 therefore, is more than possible.

In August, the Fed promised to keep interest rates at zero for the next two years. On the back of this announcement, gold shot up 15% in a couple of weeks. With the Fed promising to keep interest rates at zero, half the equation is satisfied for real rates to stay low, at least on the short end of the curve. Further expectations of interest rate hikes (of lack of hikes) will dictate what happens at the long end of the curve, and therefore what will happen to key indicators such as the yield on 10 year TIPS.

Given such definite announcements from the Fed, the direction of real rates isn’t the difficult part of the question. The timing is. Real rates could possibly sit at their current level for a year or more, with gold correspondingly standing still. Or the U.S. economy could find itself in further strife even in the coming months and real rates could drop more in the short term. We see the second scenario the more likely of the two, but the actual outcome will lie somewhere between the two. Given the Fed’s August announcement and the U.S.’s bleak economic outlook we do not see real rates increasing any time soon.

Returning to Europe for a moment, we see no positive news coming out of this area of the world for some time. Whilst the impact of the Euro crisis on gold isn’t as direct as the impact of the U.S. economy, the secondary effect of the Euro on the U.S. and hence gold is significant. The most likely scenario is further deterioration in Europe and the global economic outlook will lead to more difficulty in the U.S. triggering further easing, lower real rates and rising gold prices.

Some are predicting the start of QE3 in early 2012, if this eventuates, one would undoubtedly see lower real rates and gold pushing the $2000/oz mark in early 2012. We see QE3 as a very real possibility and any announcement, or hint will have us opening fresh positions. The next month or so could well be the calm before the storm.

We have covered the dynamics of the relationship between gold and U.S. real rates before, but for new readers and those wanting a refresher, here’s an excerpt from a previous article:

“Gold investors tend to focus overwhelmingly on the relationship between the US dollar and gold, citing that a lower dollar leads to higher gold prices in US dollars. Whilst this may be generally true, there is another relationship that does not get as much attention as we believe it deserves, and that is the relationship gold has with US real interest rates. For the first few years of this gold bull market, it was sufficient simply to acknowledge the USD down, therefore gold up dynamic, but now things have changed. Over the past couple of years gold has rallied when the greenback has been making gains, as well as when it was weakening, therefore investors must now take note of the inverse relationship between US real interest rates and gold, which has been observed consistently over the last couple of years.

The basic fundamentals behind this inverse relationship are that when US monetary policy is looser, real rates fall and therefore investors buy gold for a number of reasons.

Firstly, lower real rates could imply higher inflationary expectations in the future therefore gold is bought as a hedge against this possible inflation.

Secondly, lower real returns in Treasuries drives investors into risk assets in search of a higher return. This also sends gold higher but it also sends most commodities, risk currencies and equities higher too.

Thirdly, lower real returns on Treasuries reduce demand of US dollars, causing the dollar to fall and therefore the gold price to rise in US dollars.

Finally, looser monetary policy implies that the economic situation is not as rosy as many would like to believe, so if the Federal Reserve acts by loosening monetary policy and driving down real interest rates then that send a message that the economy is in a bad place therefore investors buy gold as a safe haven asset. There are probably many more reasons for this relationship, but we have just tried to cover the main ones.”

We believe the above explanation of U.S. real rates is the key tool for predicting gold movements. Our analysis and subsequent forecasts have been proved correct in the past and our current view is this:

In the past few months we have observed further deterioration in 10 year U.S. real rates to their current level of 0%.

As noted this is a bullish sign for gold. We would expect gold to have risen over this period to about $1800-$1900, but it is currently lagging below $1700/oz. For this reason we currently see gold as slightly undervalued, however not considerably. Any short term weakness will see us adding to our positions.

The situation in Europe looks unlikely to improve in the short to medium term. Economic reform is in the works, but this has a long term focus and will not have any effect on the underlying debt issues currently upon us. Any solution arrived at by the ECB will only buy time; the problems at hand will not be resolved long term. In fact recent ECB comments suggest that there will be no monetary easing in Europe in the short term . Comments by Draghi such as “lending money to the IMF to buy Euro bonds is not compatible with the treaty” and emphasis that the ECB’s primary remit is price stability, indicates that talk of quantitative easing in Europe appears to be off the table in the short term. Therefore, whilst we still view the downside in gold as limited, the upside over the short term is now also looking more contained.

The U.S. economy remains timid and additional deterioration in Europe would not help their plight. Further easing in early 2012 therefore, is more than possible.

In August, the Fed promised to keep interest rates at zero for the next two years. On the back of this announcement, gold shot up 15% in a couple of weeks. With the Fed promising to keep interest rates at zero, half the equation is satisfied for real rates to stay low, at least on the short end of the curve. Further expectations of interest rate hikes (of lack of hikes) will dictate what happens at the long end of the curve, and therefore what will happen to key indicators such as the yield on 10 year TIPS.

Given such definite announcements from the Fed, the direction of real rates isn’t the difficult part of the question. The timing is. Real rates could possibly sit at their current level for a year or more, with gold correspondingly standing still. Or the U.S. economy could find itself in further strife even in the coming months and real rates could drop more in the short term. We see the second scenario the more likely of the two, but the actual outcome will lie somewhere between the two. Given the Fed’s August announcement and the U.S.’s bleak economic outlook we do not see real rates increasing any time soon.

Returning to Europe for a moment, we see no positive news coming out of this area of the world for some time. Whilst the impact of the Euro crisis on gold isn’t as direct as the impact of the U.S. economy, the secondary effect of the Euro on the U.S. and hence gold is significant. The most likely scenario is further deterioration in Europe and the global economic outlook will lead to more difficulty in the U.S. triggering further easing, lower real rates and rising gold prices.

Some are predicting the start of QE3 in early 2012, if this eventuates, one would undoubtedly see lower real rates and gold pushing the $2000/oz mark in early 2012. We see QE3 as a very real possibility and any announcement, or hint will have us opening fresh positions. The next month or so could well be the calm before the storm.

The E.U says F.U. to Every Member State

Daniel Hannan is a writer and journalist, and has been Conservative MEP for South East England since 1999. He speaks French and Spanish and loves Europe, but believes that the European Union is making its constituent nations poorer, less democratic and less free.

Daniel Hannan is a writer and journalist, and has been Conservative MEP for South East England since 1999. He speaks French and Spanish and loves Europe, but believes that the European Union is making its constituent nations poorer, less democratic and less free.Please click here.

European Parliament, Strasbourg, 13 December 2011

• Speaker: Nigel Farage MEP, UKIP leader, Co-President of the EFD Group in the European Parliament (Europe of Freedom and Democracy group)

• Debate: European Council and Commission statements - Conclusions of the European Council meeting of the 8-9 December 2011 - with José Manuel Barroso and Herman Van Rompuy

- 'Blue Card' question: Alyn Smith MEP (Scottish National Party)

Group of the Greens/European Free Alliance

• Speaker: Nigel Farage MEP, UKIP leader, Co-President of the EFD Group in the European Parliament (Europe of Freedom and Democracy group)

• Debate: European Council and Commission statements - Conclusions of the European Council meeting of the 8-9 December 2011 - with José Manuel Barroso and Herman Van Rompuy

- 'Blue Card' question: Alyn Smith MEP (Scottish National Party)

Group of the Greens/European Free Alliance

Please click here.

So dear readers, what do think the chances are that Britain will still be a member of the European Union this time next year?

Regarding www.skoptionstrading.com. We have just closed another trade which generated a profit of around 23%, so our portfolio has now generated a profit of 374.43% since inception.

Please be aware that discussions are taking place regarding an increase in the price for this service for new members, so if you are thinking about joining us, then do it sooner rather later in order to avoid this additional expense.

Our model portfolio is up 384.33% since inception

An annualized return of 94.73%

Average return per trade of 36.42%

93 completed trades, 86 closed at a profit

A success rate of 92.47%

Average trade open for 49.25 days

So, the question is: Are you going to make the decision to join us today?

Banks Retrench in Europe While Keeping Up Appearances

LONDON — Stung by souring loans and troubled government bond portfolios, many European banks are being forced by regulators to raise money to build up their cash cushions against future losses.

That includes Santander, the Spanish banking giant that European regulators say has the biggest capital hole to fill: at least 15 billion euros.

So why, then, is Santander still planning to pay its shareholders 2011 dividends worth at least 2 billion euros in cash and even more in stock? That question goes to the heart of the economic challenge that Europe faces in the year ahead. A combination of government austerity, and the imposition of bigger capital safety cushions that are leading banks to retrench, seem all but certain to plunge the Continent back into recessionless than three years after emerging from the last one.But many banks are taking actions that will only intensify the blow. To preserve their allure as global brands, while trying to compensate for their battered share prices, big European banks like Santander remain intent on maintaining rich dividend payouts to shareholders. At the same time, they are selling assets, curbing lending and taking other belt-tightening measures to satisfy regulators’ demands for more capital.

“Our dividend is a sign of our expected future profits,” said José Antonio Alvarez, the chief financial officer of Santander. “Unless our expectations change we try not to cut the dividend.”

Santander, though by many measures the most generous, is not the only bank paying dividends as it scrambles to raise capital.

Its rival, the Spanish lender BBVA, plans to pay out nearly half its profits to shareholders, despite being under regulators’ orders to raise 6.3 billion euros in capital. To a lesser but still significant extent, Deutsche Bank and BNP Paribas will also be paying out dividends as they try to take in money to build their capital cushions.

All this is a sharp contrast to the way capital-short banks in the United States slashed dividends to conserve cash during the depths of the financial crisis that followed the Lehman Brothers collapse in 2008. The American government also injected cash into the banks, as Britain did with its weaker institutions.

So far, European governments have shown no inclination to do likewise for their banks. And critics say the contrast with the American experience shows how much European regulators are out of step, or even out of touch, with the banks they supervise — with potentially disturbing ramifications for the European economy.

“I do not think Europeans understand the implications of a systemic banking crisis,” said Richard Koo, the chief economist at the Nomura Research Institute in Tokyo and an expert on the financial stagnation in Japan in the 1990s. “When all banks are forced to raise capital at the same time, the result is going to be even weaker banks and an even longer recession — if not depression.”A paper Mr. Koo wrote on the subject has gone viral on the Web, with many picking up on his recommendation that the banking crisis will not be solved until European governments inject large amounts of money into their banks.

“Government intervention should be the first resort, not the last resort,” Mr. Koo said in an interview.

There is little doubt that European banks need shoring up right now. That fact was made clear Wednesday, when 523 banks tapped the European Central Bank for a record 489 billion euros (nearly $640 billion) in loans. Compared with their American peers, they have been much more dependent on borrowing in recent years to finance their lending binges.

On average, European banks’ loan books exceed their deposits by 1.2 times. In the United States the average loan-to-deposit ratio is 0.70. The upshot is that it will probably take much longer for Europe’s banks to unwind their bad loans and debt than it has for American banks.

The European Banking Authority, after a third round of stress tests in October, has ordered Europe’s fragile banks to raise more than 114 billion euros in fresh cash in the next six months. By June 2012, the region’s financial institutions will need to increase their so-called core Tier 1 capital ratio — the strictest measure of a bank’s ability to resist financial shocks — to 9 percent of assets.

That ratio, higher than the 5 percent preliminary target that the Federal Reserve set for American banks this week, reflects the acute capital strains that European banks are facing.

Regarding www.skoptionstrading.com. Our portfolio has now generated a profit of 374.43% since inception and we hope to keep it going that way next year.

Our model portfolio is up 384.33% since inception

An annualized return of 94.73%

Average return per trade of 36.42%

93 completed trades, 86 closed at a profit

A success rate of 92.47%

Average trade open for 49.25 days

So, the question is: Are you going to make the decision to join us today

World GDP: The recovery fades

20-Dec (The Economist) — THE world’s recovery from recession is slowing, according to The Economist’s measure of global GDP, based on 52 countries. Third-quarter growth expanded by 3.6% across the world, down by 1.5% from the same period in 2010.

[source]

[source]

Ties between sovereigns and banks set to deepen

22-Dec (Financial Times) — A few weeks ago, some senior officials at Bank of Tokyo Mitsubishi spotted a fascinating fact: for the first time the volume of Japanese government bonds sitting on the bank’s balance sheet swelled above corporate and consumer loans.

Yes, you read that right: at an entity such as Bank of Tokyo Mitsubishi, it is now the government – not the private sector – which is grabbing most credit, as the bank gobbles up JGBs, notwithstanding rock-bottom low rates.

More

Welcome to a key theme of 2012. During the past four decades, it was widely assumed in the western world that the main role of banks and asset managers was to provide funding to the private sector, rather than act as a piggy bank for the state. But now, that assumption – like so many of the other ideas that dominated before 2007 – is quietly crumbling. And not just in Japan.

…Whatever you want to call it, then, the state and private sector finance are becoming more entwined by the day. It is a profound irony of 21st century “market” capitalism. And in 2012, it will only deepen.

[source]

Yes, you read that right: at an entity such as Bank of Tokyo Mitsubishi, it is now the government – not the private sector – which is grabbing most credit, as the bank gobbles up JGBs, notwithstanding rock-bottom low rates.

More

Welcome to a key theme of 2012. During the past four decades, it was widely assumed in the western world that the main role of banks and asset managers was to provide funding to the private sector, rather than act as a piggy bank for the state. But now, that assumption – like so many of the other ideas that dominated before 2007 – is quietly crumbling. And not just in Japan.

…Whatever you want to call it, then, the state and private sector finance are becoming more entwined by the day. It is a profound irony of 21st century “market” capitalism. And in 2012, it will only deepen.

[source]

The Daily Market Report

Despite Correction, Gold Poised to Register Another Solid Performance in 2011

Bar1

23-Dec (USAGOLD) — Gold is consolidating just above the $1600 level going into the Christmas holiday. The last London gold fix of 2010 was $1405, so barring any dramatic price changes in the last week of the year, the yellow metal is on-track for yet another double-digit gain of about 14%.

That’s pretty impressive given the dramatic delveraging sell-off from the 1920.50 record high we saw in September, which prompted all manner of commentary proclaiming the end of gold’s decade-long rally. More recently — amid another bout of deleveraging associated with rising uncertainty about the fate of European Union — the yellow metal retested the September low at 1534.06 along with important channel support. While much was made of the technical damage done by the recent move below the 200-day moving average, gold continues to display good resilience, underpinned by solid fundamentals.

Of course someone needs to buy that debt, so we have also witnessed unprecedented — and in some instances “unlimited” — liquidity pumps to perpetuate the now institutionalized game of “hide the debt.” I don’t think that anyone really believes that more debt is really the answer to our global debt crisis, but in staving off a complete economic catastrophe several years ago with massive deficit spending and liquidity schemes, the United States effectively set the tone. Actually, the US was simply following the example set by Japan more than 20-years ago; drive interest rates to zero and hold them there by printing currency and buying bonds with it.

In fact, Japanese debt is fast approaching ¥1 quadrillion! That rather ominous benchmark is expected to be surpassed by the end of Japan’s fiscal year in March. The BoJ’s balance sheet is a startling ¥138 trillion. Meanwhile the Fed’s balance sheet has contracted in recent months, but is still in excess of $2.7 trillion. But perhaps most troubling is the expansion of the ECB’s balance sheet. Despite their persistent assurances that quantitative measures simply aren’t an option, the ECB’s balance sheet has grown by nearly a third, approaching €2.5 trillion. Hey Mr. Draghi, if you’re not engaged in QE, explain that exploding balance sheet.

There are policymakers in Europe, including ECB board member Lorenzo Bini Smaghi, that favor true — or at least un-obscured — quantitative easing by the ECB to prevent another recession in Europe. Imagine the implications for the central bank’s balance sheet if the objections are ultimately circumvented.

Late in December, the ECB unleashed a wall of money, €489 bln ($638 bln) in 3-year LTROs to 523 eurozone banks. The positive reaction to all this new liquidity was very short-lived. The euro remains under pressure and eurozone spreads have widened back out.

As the FT’s Gillian Tett pointed out in a recent column, the hope was that the banks would use this abundance of cheap ECB money to buy European sovereign debt, much in the same way that US banks plowed the proceeds from mortgage backed securities sales to the Fed into US Treasuries. Basically, the private sector ends up financing the government with funds provided by the government. Being in the middle of this financing cycle results in a potential profit bonanza for the banks.

ZIRP and liquidity. Liquidity and ZIRP. From here to eternity…

There are growing rumblings that the Fed is about to extend their ZIRP guidance from mid-2013 out to 2014 and potentially beyond. I’m sure when the BoJ launched their quantitative measures they were expected to last maybe a couple of years. Here it is 20 some years later and Japan still has 0% interest rates. Do you suppose this is our fate as well?

Some of the major financial firms are predicting lofty average gold prices for the coming year: Goldman Sachs $1810, Barclays $2000 and UBS $2050 to name just a few. We maintain that the long-term uptrend in gold is protected as long as we remain in a negative real interest rate environment. This in fact seems all-but assured for quite some time. On top of that, the ongoing expansions of debt, monetary bases and central bank balance sheets, along with broadly positive supply/demand dynamics — highlighted by robust investment and central bank demand — conspire to underpin gold as well in the new year.

On behalf of everyone here at USAGOLD – Centennial Precious Metals, we wish you a very merry Christmas and a most prosperous 2012.

Bar1

23-Dec (USAGOLD) — Gold is consolidating just above the $1600 level going into the Christmas holiday. The last London gold fix of 2010 was $1405, so barring any dramatic price changes in the last week of the year, the yellow metal is on-track for yet another double-digit gain of about 14%.

That’s pretty impressive given the dramatic delveraging sell-off from the 1920.50 record high we saw in September, which prompted all manner of commentary proclaiming the end of gold’s decade-long rally. More recently — amid another bout of deleveraging associated with rising uncertainty about the fate of European Union — the yellow metal retested the September low at 1534.06 along with important channel support. While much was made of the technical damage done by the recent move below the 200-day moving average, gold continues to display good resilience, underpinned by solid fundamentals.

Monthly Gold Chart

Daily Gold Chart

Those supporting fundamentals are unlikely to change anytime soon as the world continues to seek solutions for an overwhelming level of debt and anemic growth prospects. Thus far, the focus remains on creating more of what is arguably to primary source of the problem. Debt.

Of course someone needs to buy that debt, so we have also witnessed unprecedented — and in some instances “unlimited” — liquidity pumps to perpetuate the now institutionalized game of “hide the debt.” I don’t think that anyone really believes that more debt is really the answer to our global debt crisis, but in staving off a complete economic catastrophe several years ago with massive deficit spending and liquidity schemes, the United States effectively set the tone. Actually, the US was simply following the example set by Japan more than 20-years ago; drive interest rates to zero and hold them there by printing currency and buying bonds with it.

In fact, Japanese debt is fast approaching ¥1 quadrillion! That rather ominous benchmark is expected to be surpassed by the end of Japan’s fiscal year in March. The BoJ’s balance sheet is a startling ¥138 trillion. Meanwhile the Fed’s balance sheet has contracted in recent months, but is still in excess of $2.7 trillion. But perhaps most troubling is the expansion of the ECB’s balance sheet. Despite their persistent assurances that quantitative measures simply aren’t an option, the ECB’s balance sheet has grown by nearly a third, approaching €2.5 trillion. Hey Mr. Draghi, if you’re not engaged in QE, explain that exploding balance sheet.

There are policymakers in Europe, including ECB board member Lorenzo Bini Smaghi, that favor true — or at least un-obscured — quantitative easing by the ECB to prevent another recession in Europe. Imagine the implications for the central bank’s balance sheet if the objections are ultimately circumvented.

Late in December, the ECB unleashed a wall of money, €489 bln ($638 bln) in 3-year LTROs to 523 eurozone banks. The positive reaction to all this new liquidity was very short-lived. The euro remains under pressure and eurozone spreads have widened back out.

As the FT’s Gillian Tett pointed out in a recent column, the hope was that the banks would use this abundance of cheap ECB money to buy European sovereign debt, much in the same way that US banks plowed the proceeds from mortgage backed securities sales to the Fed into US Treasuries. Basically, the private sector ends up financing the government with funds provided by the government. Being in the middle of this financing cycle results in a potential profit bonanza for the banks.

ZIRP and liquidity. Liquidity and ZIRP. From here to eternity…

There are growing rumblings that the Fed is about to extend their ZIRP guidance from mid-2013 out to 2014 and potentially beyond. I’m sure when the BoJ launched their quantitative measures they were expected to last maybe a couple of years. Here it is 20 some years later and Japan still has 0% interest rates. Do you suppose this is our fate as well?

Some of the major financial firms are predicting lofty average gold prices for the coming year: Goldman Sachs $1810, Barclays $2000 and UBS $2050 to name just a few. We maintain that the long-term uptrend in gold is protected as long as we remain in a negative real interest rate environment. This in fact seems all-but assured for quite some time. On top of that, the ongoing expansions of debt, monetary bases and central bank balance sheets, along with broadly positive supply/demand dynamics — highlighted by robust investment and central bank demand — conspire to underpin gold as well in the new year.

On behalf of everyone here at USAGOLD – Centennial Precious Metals, we wish you a very merry Christmas and a most prosperous 2012.

الأحد، 29 مايو 2011

“Risk-On, Risk-Off”

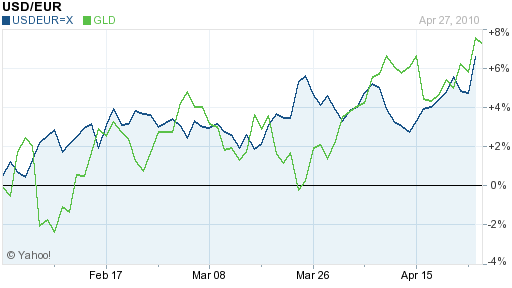

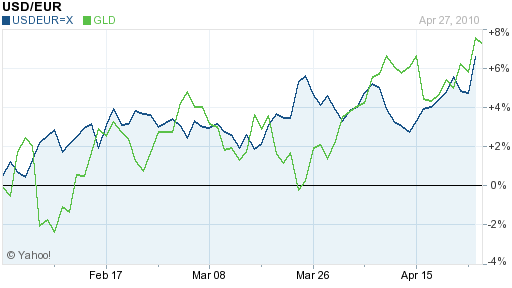

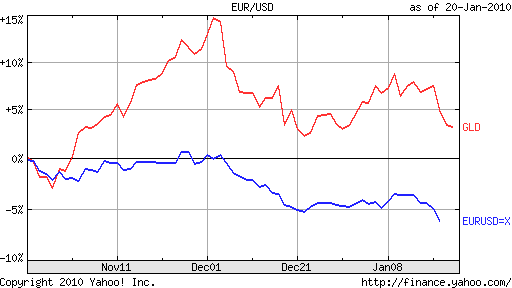

It sounds like a play on words, based on the Karate Kid refrain, Wax-On Wax Off, and for all I know it was. Still, I rather like this characterization – coined by a research team at HSBC – of the markets‘ current performance. Moreover, you’ll notice from the placement of that apostrophe that I’m not just talking about forex markets, but about the financial markets in general.

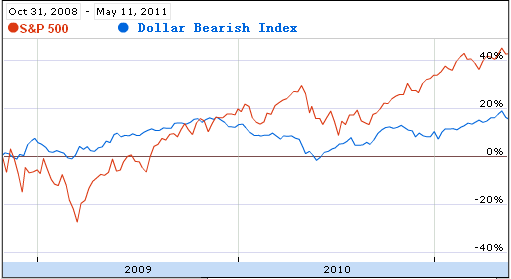

What we mean is that when risk appetite is high, credit markets and equities and high-yielding currencies tend to rally together. When risk appetite fades, “those assets fall and government bonds and safe-haven currencies, including the U.S. dollar, the Swiss franc and, in particular, the Japanese yen rally.” Data from Bloomberg News confirms this phenomenon: “The 120-day negative correlation between Intercontinental Exchange Inc.’s Dollar Index and the Standard & Poor’s 500 Index was at 42.4 percent today, and has been mostly above 40 percent since June 2009.”Skeptics counter that this correlation is tautological. Anyone can point to a stock market rally and declare that “Risk is Back On.” In addition, it’s not wholly unsurprising that there are strong correlations between low-risk currencies and low-risk assets, and between high-risk currencies and high-risk assets. According to HSBC, however, this time is different.

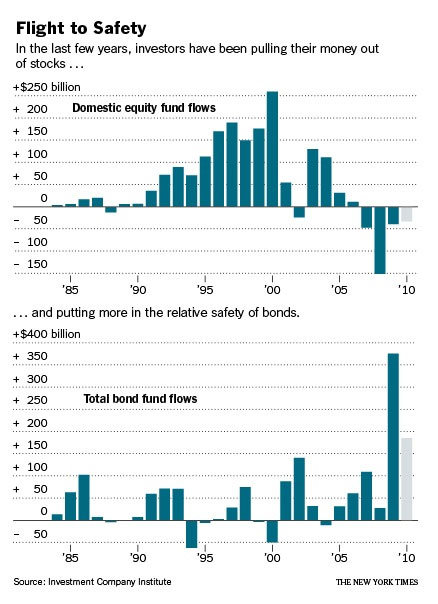

Statisticians love to teach the dictum, Correlation does not imply causation. Nonetheless, I think that in this case, I’d wager to say that the equity and credit/bond markets are driving forex, rather than the other way around. Consider as evidence that, “[Retail] Investors withdrew a staggering $33.12 billion from domestic stock market mutual funds in the first seven months of this year,” and shifted this capital into bonds. While this wouldn’t in itself be enough to drive the Dollar higher, it epitomizes the steady shifts that have been taking place in capital markets for nearly a year, broken only by the S&P/Euro rally in the spring (which now appears to have been an aberration).

In fact, these shifts are once again creating shortages of Dollars: “This week, two banks bid at the European Central Bank’s weekly dollar liquidity providing auction – the first time there have been any bids since May – suggesting that they could not raise dollars in the market.” This suggests that demand for the Dollar could continue to grow.

Some analysts have suggested that the low-yielding US Dollar is already on its way to becoming a funding currency for carry traders, but I think this is wishful thinking. The HSBC report supports this conclusion, “A weakening of the ‘risk on-risk off’ paradigm is likely only once macro conditions are improved in a sustainable way…Currency performance will likely be tied to the ebb and flow of the perception of risk for some months to come.” In short, until there is solid proof that the global economy has emerged from recession (even if ironically it is the US which is leading the pack downward), the Dollar will probably remain strong.

Trading In Emerging/Exotic Currencies Increases

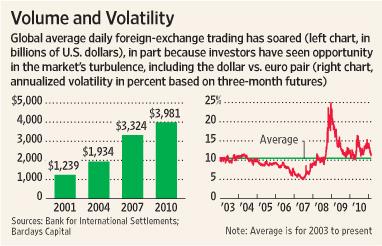

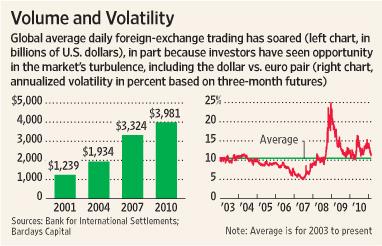

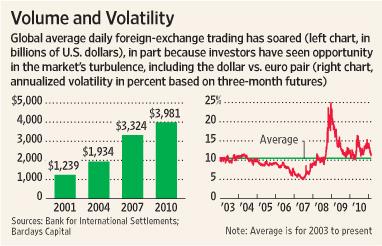

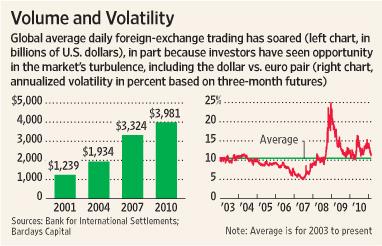

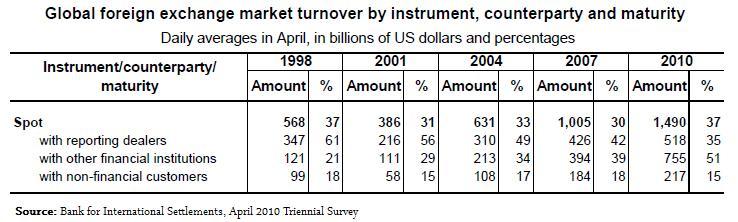

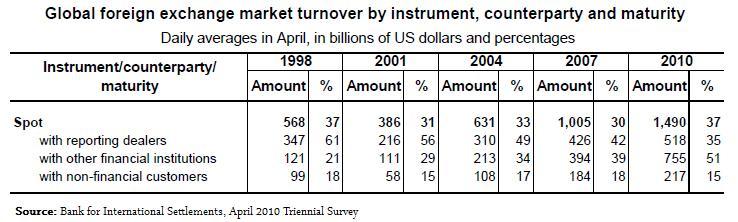

The long wait is over! The Bank of International Settlements (BIS) has just released the results from its Triennial Central Bank Survey of Foreign Exchange and Derivatives Market Activity, conducted in April 2010. The report contains a veritable treasure trove of data, perhaps enough to keep analysts busy until the next report is released in 2013. [Chart below courtesy of WSJ].

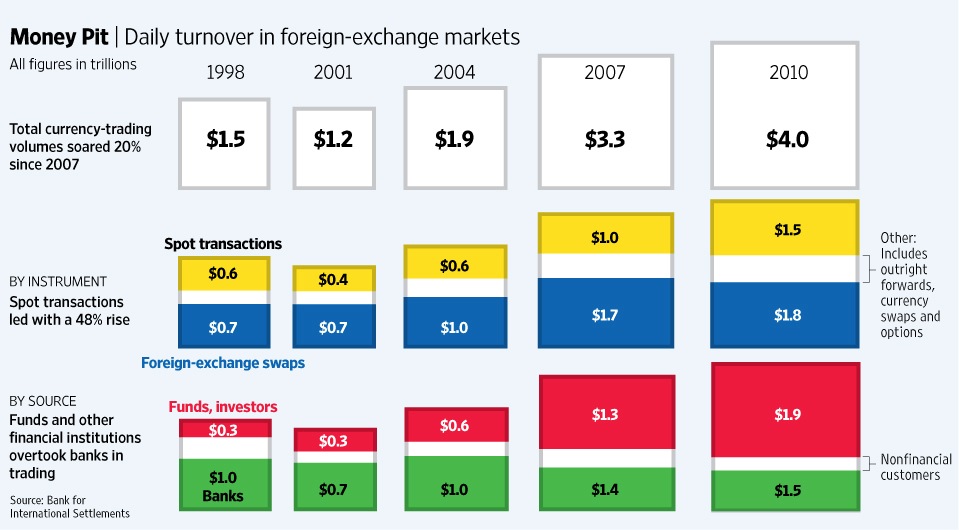

First, the data confirmed earlier reports that average daily forex volume had surged to a record level in 2010: “Global foreign exchange market turnover was 20% higher in April 2010 than in April 2007, with average daily turnover of $4.0 trillion compared to $3.3 trillion. The increase was driven by the 48% growth in turnover of spot transactions, which represent 37% of foreign exchange market turnover. The increase in turnover of other foreign exchange instruments [consisting mainly of swaps and accounting for the majority of forex trading activity] was more modest at 7%.” In addition, for the first time, investors and financial institutions accounted for a larger share of turnover than banks, whose trading activity has remained roughly unchanged since 2004.

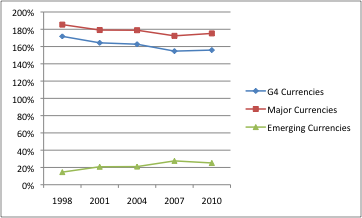

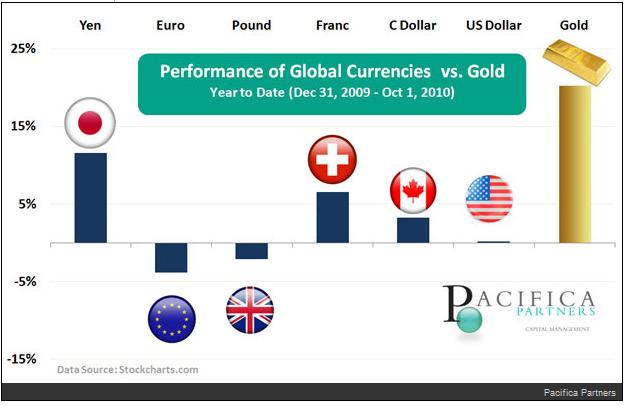

The composition of the turnover actually didn’t change from 2007, interrupting a shift which had been taking place over the previous 10 years. Specifically, the share of overall turnover accounted for by the so-called major currencies actually increased in 2010, from 172% to 175%. [Since there are two currencies in every transaction, total volume sums to 200%]. Growth in the G4 currencies (Dollar, Euro, Pound, Yen) was more modest, however, increasing from 154% to 155%. This reversal is probably attributable to the credit crisis, which drove (and in fact, continues to drive) investors out of emerging market currencies and back into safe haven currencies, namely the Dollar, Yen, and Pound. However, this theory is belied by the significant increase in Euro trading activity, which certainly hasn’t benefited from the recent trend towards risk aversion.

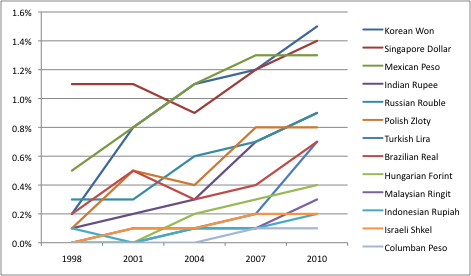

While emerging currencies as a group accounted for a smaller share of overall activity, certain individual currencies managed to increase their respective shares. The Singapore Dollar, Korean Won, New Turkish Lira, and Brazilian Real all fit into this category. Still other currencies, such as the Indonesian Rupiah and Malaysian Ringgit, also managed impressive gains but account for such a small share of volume as to be insignificant when looking at the overall the picture. Those who were expecting even bigger growth should remember that it’s ultimately a numbers game: the amount of Ringgit it outstanding is dwarfed by the number of Dollars, so any gains that the Ringgit can eke out are impressive. In addition, when you consider that the overall forex pie is also increasing, the nominal increase in volume for these small currencies was actually quite large.

The ongoing search for yield in all corners of the financial markets is likely to bring some of the more obscure currencies into the fold. “In June, I began getting questions about Uruguay, Vietnam and others,” said Win Thin, senior currency strategist at Brown Brothers Harriman in New York…investors often asked Mr. Thin questions about less-familiar currencies such as the Ukrainian hryvnia and Romanian leu.” In the same article, however, Mr. Thin cautioned that interest in such currencies is still probably lower than in 2007-2008, for a good reason. “It’s not like the Group of 10, or even the more liquid emerging market currencies where, if you decide you’ve made a mistake, you can get out.”

Due to the lack of liquidity and higher spreads, these obscure currencies aren’t really suitable for trading. Of course there will be a handful of institutional and even retail investors that want to make long-term bets on these currencies. They tend to be more aware of the risk and less sensitive to the higher cost and lower convenience. The overwhelming majority of traders, however, churn their portfolios daily, if not hundreds of times per day. A 10pip spread on the USD/MXN (Dollar/Mexican Peso) would be considered too high, let alone a 50 pip spread on any transaction involving the Ukrainian hryvnia.

In short, the majors will account for the majority of trading volume for the foreseeable future, regardless of what happens to the Euro. At the same time, that won’t prevent a handful of selected emerging currencies, such as the Chinese Yuan, Indian Rupee, Brazilian Real, and Russian Ruble from increasing their share. As liquidity rises and spreads decline, volume will increase, and their rising importance will become self-fulfilling.

Trend is your friend

Raise your hand if you’ve ever heard that expression before? Well, now there’s proof that this well-worn phrase is more than just a pointless platitude: “Royal Bank of Scotland Group indexes that track the performance of four of the most popular currency strategies show that the so-called trend style was the best-performing method, returning 7.3 percent this year through August.”

“Trend-Style” trading is also known as trend-following, and is just as it sounds. Traders identify one-way patterns in specific currency pair(s), and attempt to ride them for as long as possible. Given all of the big movements in currency markets this year, it’s no wonder that trend-following is the most popular. If you look at the 52 week trading ranges for the six most popular USD currency pairs, you can see that highs and lows are often as far as 20% apart. The EUR/USD pair, for example, fell 20% over a mere 7 months. Anyone who sold in December 2009 and bought to cover in June 2010 would have earned an annualized return of 35% without leverage! Even if you had captured only a couple months of depreciation would have yielded impressive returns. In addition, you could have traded the Euro back up from June until August and reaped a 60% annualized return. Best of all, both of these trends (down, then up) unfolded very smoothly, with only minor corrections along the way.

I’m sure serious technical analysts are rolling their eyes at the chart above, but the point stands that trend-following has never been easier and rarely more profitable than it is now. One fund manager summarized, “Trend-following investors are capturing the momentum in several big currency moves. You have so much uncertainty in the world now with regard to inflation or deflation, which typically makes currency markets and interest rates move. That is good for trend followers as it causes volatility, which typically creates good profits.” In other words, there is a tremendous amount happening in forex markets at the moment, and this is reflected in protracted, deep moves in currency pairs, which can change direction without notice and yet continue moving the opposite way for just as long. If you think this sounds obvious, look at historical data (5-10 years) for the majority of currency pairs: while trends have always been abundant, it was only recently that they began to last longer and became more pronounced.

I’m sure serious technical analysts are rolling their eyes at the chart above, but the point stands that trend-following has never been easier and rarely more profitable than it is now. One fund manager summarized, “Trend-following investors are capturing the momentum in several big currency moves. You have so much uncertainty in the world now with regard to inflation or deflation, which typically makes currency markets and interest rates move. That is good for trend followers as it causes volatility, which typically creates good profits.” In other words, there is a tremendous amount happening in forex markets at the moment, and this is reflected in protracted, deep moves in currency pairs, which can change direction without notice and yet continue moving the opposite way for just as long. If you think this sounds obvious, look at historical data (5-10 years) for the majority of currency pairs: while trends have always been abundant, it was only recently that they began to last longer and became more pronounced.The other three strategies surveyed by the Royal Scotland Group (“RSG”) were the Carry Trade, Value Trade, and Volatility Trade. Unfortunately, data was only offered for the carry trade strategy (confusingly referred to by RSG as the volatility strategy), which is down 5.9% in the year-to-date. The carry trade strategy involves selling a currency with a low yield and favor of one with a high yield, and profiting from the interest rate spread. In order for this strategy to be profitable, however, the long currency must either appreciate or remain constant. Thus, when volatility is high – as it has been over the last 2-3 years – this is a losing strategy.

We can only guess that a true volatility strategy probably would have been the second most profitable strategy. This strategy can be implemented through the use of long and short spot positions, as well as through trading in options and other derivatives. As I said, there is no shortage of volatility at the moment: “Since the collapse of Lehman Brothers in 2008, the dollar has seen record volatility against the euro…including six moves of at least 10%.” For traders that profit from volatility, the current uncertainty has created a windfall situation.

However, it has made value trading – based on fundamentals and the notion of Purchasing Power Parity (PPP) – risky and unpopular: “The volatility also has made what would appear to be a straightforward bet against the dollar fraught with risk. Three factors tend to move currencies: the pace of growth, debt levels and interest rates. By those standards, the dollar should be falling against the currencies of emerging-market and commodity-producing nations.” Not only is this not the case (a decline in risk appetite has turned the Dollar into a safe-haven), but even betting on a protracted Dollar decline is itself risky because of surging volatility. One way around this is to trade a Dollar Index (by way of an ETF, for example) which is inherently less volatile (half as volatile, to be exact) than individual currency pairs.

That’s not to say that value trading isn’t profitable over the long-term. “Empirical evidence suggests that currencies…show a tendency to revert back toward PPP in the longer run.” Given current volatility/uncertainty, however, this strategy is unlikely to be profitable in the short run. Fortunately, uncertainty doesn’t negate opportunity, and traders should plot strategy accordingly.

CFTC / NFA Enhance Regulation of Forex

In 2010, the US Commodity Future Trading Commission (CFTC) formally released a series of new regulations governing all retail foreign exchange dealers. Having given all applicable firms almost six months to bring their operations up to speed with the new regulations, the CFTC is now moving to bring enforcement actions against those that are still not in compliance.

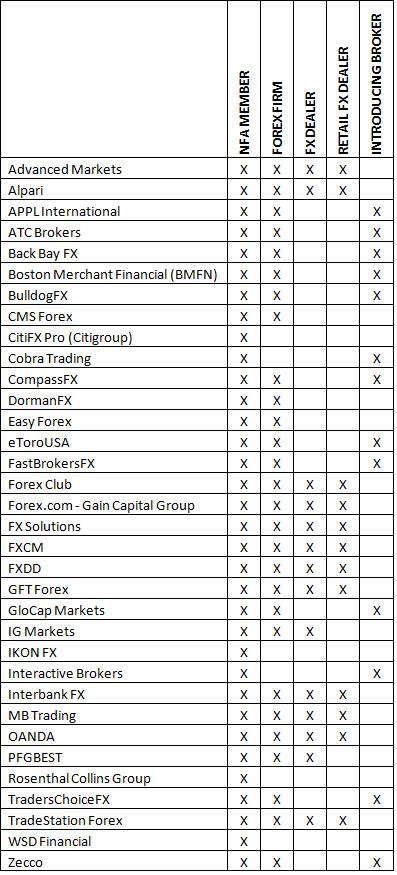

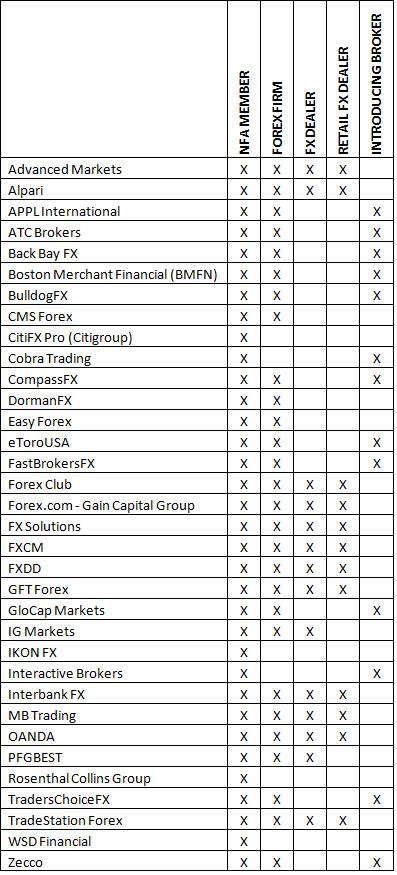

Among other things, the regulations required all retail forex broker-dealers to register accordingly with the National Futures Association (NFA), and for firms that “solicit orders, exercise discretionary trading authority or operate pools with respect to retail forex” to register as introducing brokers. Out of curiosity, I scoured the NFA Background Affiliation Status Information Center (BASIC) to see if/how forex brokers have registered themselves.

As you can see from the table above, there are approximately [I would be grateful if you could inform me of any known omissions!] 28 registered forex firms, and the CFTC recommends that (US) retail forex traders that manage their own accounts should deal with these firms exclusively.

Unfortunately, many firms continue to advertise that themselves as forex brokers when they aren’t registered as such, or even worse, aren’t registered at all. As a result, the CFTC recently filed simultaneous enforcement actions against 14 forex firms, alleging that, “In all but two of the complaints…a defendant acted as an RFED; that is, it offered to take or took the opposite side of a customer’s forex transaction without being registered. In the remaining two complaints, ZtradeFX LLC and FXPRICE, the CFTC alleges that the defendant solicited customers to place forex trades at an RFED without being registered as an Introducing Broker.” The following companies stand accused:

To be a fair, NFA membership doesn’t necessarily imply compliance with NFA regulations, nor does it even guarantee upright behavior. In fact, the NFA is currently scrutinizing all of its member firms “for any signs they are designing computer systems to take advantage of what is known in the industry as ‘slippage,’ or small price movements that happen between the time a customer orders a trade and when that trade is actually executed.” In October, the NFA settled two such cases with IKON FX and Gain Capital, assessing a combined $800,000 in fines. Let’s hope that this isn’t the real explanation for the fact that forex trading is vastly more profitable for brokerages than other types of retail securities trading.

While the NFA hasn’t indicated that this is the case, the current retail forex MO (whereby brokers also act as market-makers) could be under attack. As one advocate for traders told the WSJ, “If a foreign-exchange firm is acting as a market-maker, or taking the other side of a client’s trades, it is doubtful the investor is getting the best possible price.” The problem is at the moment, the industry remains far from transparent, and if not for the NFA investigations, traders probably wouldn’t be able to establish whether their broker(s) acted unscrupulously.

Among other things, the regulations required all retail forex broker-dealers to register accordingly with the National Futures Association (NFA), and for firms that “solicit orders, exercise discretionary trading authority or operate pools with respect to retail forex” to register as introducing brokers. Out of curiosity, I scoured the NFA Background Affiliation Status Information Center (BASIC) to see if/how forex brokers have registered themselves.

As you can see from the table above, there are approximately [I would be grateful if you could inform me of any known omissions!] 28 registered forex firms, and the CFTC recommends that (US) retail forex traders that manage their own accounts should deal with these firms exclusively.

Unfortunately, many firms continue to advertise that themselves as forex brokers when they aren’t registered as such, or even worse, aren’t registered at all. As a result, the CFTC recently filed simultaneous enforcement actions against 14 forex firms, alleging that, “In all but two of the complaints…a defendant acted as an RFED; that is, it offered to take or took the opposite side of a customer’s forex transaction without being registered. In the remaining two complaints, ZtradeFX LLC and FXPRICE, the CFTC alleges that the defendant solicited customers to place forex trades at an RFED without being registered as an Introducing Broker.” The following companies stand accused:

To be a fair, NFA membership doesn’t necessarily imply compliance with NFA regulations, nor does it even guarantee upright behavior. In fact, the NFA is currently scrutinizing all of its member firms “for any signs they are designing computer systems to take advantage of what is known in the industry as ‘slippage,’ or small price movements that happen between the time a customer orders a trade and when that trade is actually executed.” In October, the NFA settled two such cases with IKON FX and Gain Capital, assessing a combined $800,000 in fines. Let’s hope that this isn’t the real explanation for the fact that forex trading is vastly more profitable for brokerages than other types of retail securities trading.

While the NFA hasn’t indicated that this is the case, the current retail forex MO (whereby brokers also act as market-makers) could be under attack. As one advocate for traders told the WSJ, “If a foreign-exchange firm is acting as a market-maker, or taking the other side of a client’s trades, it is doubtful the investor is getting the best possible price.” The problem is at the moment, the industry remains far from transparent, and if not for the NFA investigations, traders probably wouldn’t be able to establish whether their broker(s) acted unscrupulously.

Hedging High Forex Uncertainty

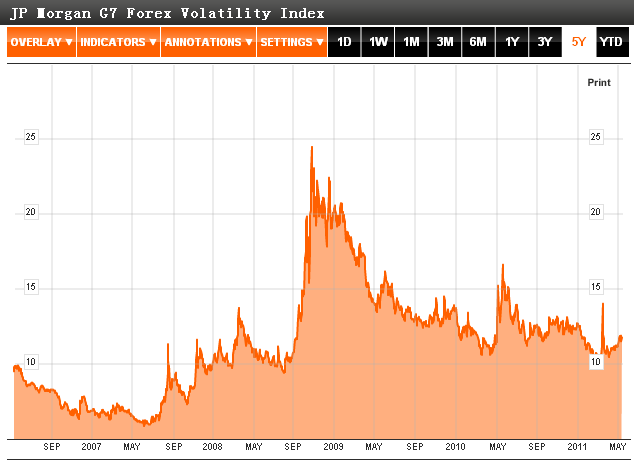

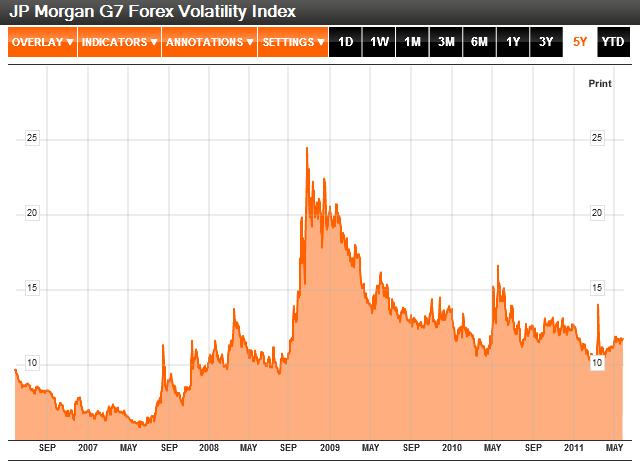

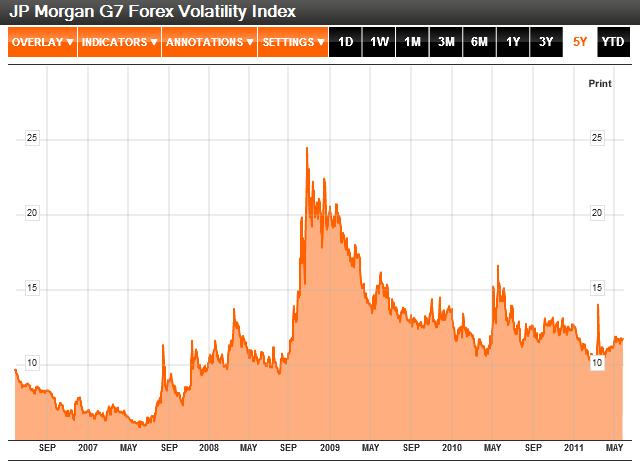

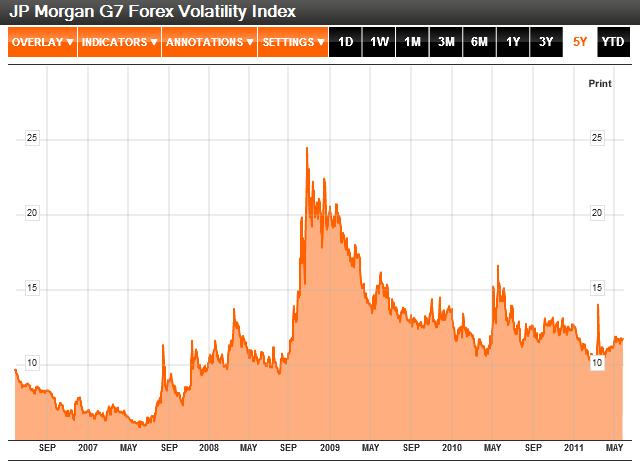

In forex, everything is relative. That is no less the case for forex volatility, which is low relative to the spikes in 2008 (credit crisis) and 2010 (EU Sovereign debt crisis), but high relative to the preceding 5+ years of stability. On the one hand, volatility is approaching a two year low. On the other hand, analysts continue to warn of high volatility for the foreseeable future. Under these conditions, what are (currency) investors supposed to do?!

Despite the steady pickup in risk appetite in 2010, there remains a whole a host of forex risk factors. On the economic front, GDP growth remains anemic in western countries, unemployment is high, and consumer confidence is low. Budget deficits and national debts are rising, perhaps to the point that default by a major industrialized countries is inevitable. Emerging market countries seem to be ‘suffering’ from the opposite problem, whereby rapid growth, high commodities prices, and capital inflow has caused inflation to rise precipitously. Some Central Banks will be forced to hike interest rates, while others will try to maintain an easy monetary policy for as long as possible. Political crises flare-up without warning, the Euro risks breaking up, and inclement weather is wreaking havoc on food production.

As a result, most currency-market watchers expect 2011 to be a continuation of 2010. In other words, while we might be spared a major crisis, a generalized sense of uncertainty will continue to pervade forex. According to JP Morgan, “Implied volatility on options for major exchange rates averaged 12.34 percent this year, compared with an average of 10.6 percent since January 2000.” The currency team of UBS predicts, “The divergence between the strength in emerging markets and the unusual levels of uncertainty in the world’s major economies will cause…super volatility,” whereby massive swings in exchange rates will become the norm.

As a result, most currency-market watchers expect 2011 to be a continuation of 2010. In other words, while we might be spared a major crisis, a generalized sense of uncertainty will continue to pervade forex. According to JP Morgan, “Implied volatility on options for major exchange rates averaged 12.34 percent this year, compared with an average of 10.6 percent since January 2000.” The currency team of UBS predicts, “The divergence between the strength in emerging markets and the unusual levels of uncertainty in the world’s major economies will cause…super volatility,” whereby massive swings in exchange rates will become the norm.

In this environment, there are a number of things that currency traders should do. The first step is simply to be aware that volatility remains high, which means that wider-than-average fluctuations shouldn’t be a surprise. The next step is to decide whether you think that this volatility will remain at an elevated level for the near-term, or whether you expect it to continue declining. (It’s worth pointing out that volatility is not necessarily a perception of absolute risk, but investor perception of risk). The final step is deciding if/how you will tailor your trading strategy in response to changes in volatility.

In fact, you don’t necessarily need to limit your exposure to volatility. If you are a fundamental investor with a long-term approach, you may very well choose to write-off short-term fluctuations as noise. (Of course, if you are a short-term swing trader, you can’t afford to be quite so indifferent). In addition, if your primary interest is in another asset type, you may choose not to hedge any currency risk. Perhaps you believe that the base currency will continue appreciated and/or you relish the exposure to currency movements as an added benefit of asset price exposure. Along these lines, “During the planning stages of the UBS Emerging Markets Equity Income fund, UBS Global Asset Management considered offering investors a hedged share class. The team abandoned the idea when investors showed a preference for unhedged share classes.”

In addition, hedging currency risk is expensive, especially for exotic/illiquid currencies, and currencies characterized by above average volatility. Not to mention that currency hedges can still move against investors, resulting in heavy losses. Still, in 2010, “Corporations from the U.S., Japan and Europe increased the percentage of projected income protected against swings in exchange rates to a record,” which suggests that fear of adverse exchange rate movements still predominates.

Finally, there are those that want to construct second-order currency strategies based entirely on volatility. Using basic options techniques, such as spreads and straddles, it’s possible to profit from volatility (or lack thereof) regardless of which direction the underlying currencies move in. In fact, the CME Group recently introduced a new product series which seeks to perform this very function. Investors can already buy and sell futures based on short-term volatility in the EUR/USD, which will soon be replicated for all of the major currency pairs.

For those of you who like to keep it simple, it’s probably enough to monitor the JP Morgan G7 Currency Volatility Index, which is a good proxy for the risk associated with trading (major) currencies at any given time. When this index spikes, chances are the US Dollar and other safe haven currencies will follow suit.

Despite the steady pickup in risk appetite in 2010, there remains a whole a host of forex risk factors. On the economic front, GDP growth remains anemic in western countries, unemployment is high, and consumer confidence is low. Budget deficits and national debts are rising, perhaps to the point that default by a major industrialized countries is inevitable. Emerging market countries seem to be ‘suffering’ from the opposite problem, whereby rapid growth, high commodities prices, and capital inflow has caused inflation to rise precipitously. Some Central Banks will be forced to hike interest rates, while others will try to maintain an easy monetary policy for as long as possible. Political crises flare-up without warning, the Euro risks breaking up, and inclement weather is wreaking havoc on food production.

In this environment, there are a number of things that currency traders should do. The first step is simply to be aware that volatility remains high, which means that wider-than-average fluctuations shouldn’t be a surprise. The next step is to decide whether you think that this volatility will remain at an elevated level for the near-term, or whether you expect it to continue declining. (It’s worth pointing out that volatility is not necessarily a perception of absolute risk, but investor perception of risk). The final step is deciding if/how you will tailor your trading strategy in response to changes in volatility.

In fact, you don’t necessarily need to limit your exposure to volatility. If you are a fundamental investor with a long-term approach, you may very well choose to write-off short-term fluctuations as noise. (Of course, if you are a short-term swing trader, you can’t afford to be quite so indifferent). In addition, if your primary interest is in another asset type, you may choose not to hedge any currency risk. Perhaps you believe that the base currency will continue appreciated and/or you relish the exposure to currency movements as an added benefit of asset price exposure. Along these lines, “During the planning stages of the UBS Emerging Markets Equity Income fund, UBS Global Asset Management considered offering investors a hedged share class. The team abandoned the idea when investors showed a preference for unhedged share classes.”

In addition, hedging currency risk is expensive, especially for exotic/illiquid currencies, and currencies characterized by above average volatility. Not to mention that currency hedges can still move against investors, resulting in heavy losses. Still, in 2010, “Corporations from the U.S., Japan and Europe increased the percentage of projected income protected against swings in exchange rates to a record,” which suggests that fear of adverse exchange rate movements still predominates.

Finally, there are those that want to construct second-order currency strategies based entirely on volatility. Using basic options techniques, such as spreads and straddles, it’s possible to profit from volatility (or lack thereof) regardless of which direction the underlying currencies move in. In fact, the CME Group recently introduced a new product series which seeks to perform this very function. Investors can already buy and sell futures based on short-term volatility in the EUR/USD, which will soon be replicated for all of the major currency pairs.

For those of you who like to keep it simple, it’s probably enough to monitor the JP Morgan G7 Currency Volatility Index, which is a good proxy for the risk associated with trading (major) currencies at any given time. When this index spikes, chances are the US Dollar and other safe haven currencies will follow suit.

Forex Volatility Rises from Multi-Year Lows

In the last month, volatility in the forex markets touched both a two-year low and a one-year high. In the beginning of March, volatility essentially returned to pre-credit crisis levels. One week later, when the earthquake and inception of the nuclear crisis in Japan, volatility surged 40%. While it has since resumed its downward path, investors are still bracing themselves for continued uncertainty.

The carry trade has perhaps born the brunt of the volatility spike. The carry trade depends on interest rate differentials – as opposed to currency appreciation – to drive profits, and thus demands stability. When the markets become choppy and exchange rates spike wildly in one direction or another, it makes the carry trade significantly more risky. Hence the paradoxical rise of the Japanese Yen to a record high following a series of crushing disasters, as highly leveraged traders moved to unwind their Yen-short carry trades.Likewise, high volatility should spur demand for so-called safe haven currencies. If only it were clear what constitutes a safe haven currency. Traditionally, that would send the US Dollar, Swiss Franc, and Japanese Yen upwards. In this case, the Franc has benefited most, followed closely by the Yen. The Dollar spiked against emerging market and high-risk currencies, but hardly budged against its G4 counterparts. Could it be that the Dollar’s multi-year positive correlation with volatility has (temporarily?) abated.

With regard to strategy, currency traders have a handful of choices. If you believe that volatility will continue declining or remain stable, you’re probably going to go long emerging market and high-yielding currencies, and short one of the safe-haven currencies, all of which are quite cheap to borrow. The main risk of such a strategy, of course, is that volatility will once again spike, in which these safe have currencies will rally.

If you think that the ebb and volatility isn’t sustainable, then you’re probably going to bet on the Franc, Dollar, or Yen. As I wrote in an earlier post, I think the Yen could theoretically appreciate in the short-term, but actually remains quite risky over the long-term. Despite the best efforts of the Swiss National Bank, the Franc will probably continue appreciation. Economically and monetarily, it is in an excellent shape. Besides, the fact that the supply of Francs is intrinsically small means that even modest capital inflow often translates into a big jump in its its value. As for the Dollar, it is now the most popular currency to short. It remains a safe choice and a good store of value, but probably won’t deliver the returns that safe-haven strategists have come to expect.

From a practical standpoint, you may also want to consider reducing your leverage. As everyone knows, high leverage increases profits but also magnifies losses. In the current environment of heightened volatility, leverage also magnifies risk. Either way, you may also want to consider hedging your exposure, by trading a basket of currencies and/or through the use of options.

The carry trade has perhaps born the brunt of the volatility spike. The carry trade depends on interest rate differentials – as opposed to currency appreciation – to drive profits, and thus demands stability. When the markets become choppy and exchange rates spike wildly in one direction or another, it makes the carry trade significantly more risky. Hence the paradoxical rise of the Japanese Yen to a record high following a series of crushing disasters, as highly leveraged traders moved to unwind their Yen-short carry trades.

With regard to strategy, currency traders have a handful of choices. If you believe that volatility will continue declining or remain stable, you’re probably going to go long emerging market and high-yielding currencies, and short one of the safe-haven currencies, all of which are quite cheap to borrow. The main risk of such a strategy, of course, is that volatility will once again spike, in which these safe have currencies will rally.

If you think that the ebb and volatility isn’t sustainable, then you’re probably going to bet on the Franc, Dollar, or Yen. As I wrote in an earlier post, I think the Yen could theoretically appreciate in the short-term, but actually remains quite risky over the long-term. Despite the best efforts of the Swiss National Bank, the Franc will probably continue appreciation. Economically and monetarily, it is in an excellent shape. Besides, the fact that the supply of Francs is intrinsically small means that even modest capital inflow often translates into a big jump in its its value. As for the Dollar, it is now the most popular currency to short. It remains a safe choice and a good store of value, but probably won’t deliver the returns that safe-haven strategists have come to expect.

From a practical standpoint, you may also want to consider reducing your leverage. As everyone knows, high leverage increases profits but also magnifies losses. In the current environment of heightened volatility, leverage also magnifies risk. Either way, you may also want to consider hedging your exposure, by trading a basket of currencies and/or through the use of options.

Retail Forex: Lower Corporate Profits = Lower Spreads for Traders?

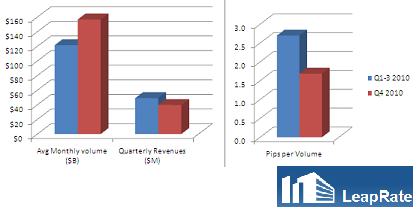

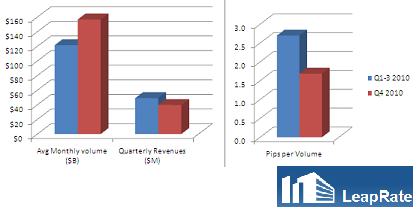

In December 2010, both GAIN Capital and FXCM became public companies. This was thought both to signal the maturing of an industry and to herald the start of a period of explosive growth. Since then, the share prices for both companies have fallen dramatically, even while the S&P 500 has continued to rise. Trading volume has remained flat, and revenues have declined. As a result, analysts (myself included) are starting to question not only the operations of these two firms, but also of the entire industry.

Before we jump to conclusions, it’s important to understand the basis for this sudden aura of uncertainty . First of all, both firms – as well as the broader forex industry – have found themselves the subject of increased regulatory scrutiny, and consequent disciplinary action. Second, trading volume has been impacted by an uptick in volatility. Third, an increase in institutional trading volume has not translated into a proportional increase in revenues/profits. Fourth, the recent tightening of leverage rules (which may be helping traders!) has eroded a large profit center. Finally, high account turnover suggests that the brokers will eventually run out of customers.

I don’t want to dwell on the industry’s regulatory travails (since I have blogged about it before), except to say that I think it’s a good thing. It will bring greater transparency, and generally make trading safer and cheaper. For more information on the specific allegations and (potential) regulatory response, the WSJ recently published an excellent overview.

As for the temporary decline in retail trading volume, this is probably temporary. Overall forex volume has tripled over the last decade, and it is forecast to triple again over the coming decade. In addition, the mainstreaming of currency trading will spur millions of investors to at least dabble on forex. Unfortunately, this will probably be offset by a decline in trading activity by existing customers, as the majority come to terms with the difficulty of profiting through high-volume/high-leverage trading.

Furthermore, increased volume will combine with increased competition to facilitate lower spreads. According to a recent report by LeapRate, GAIN Capital now earns an average of only 1.7 pips per trade, a stunning drop for the 2.7 pips that it averaged during most of 2010. Basically, the same thing is now happening to forex that decimalization and computerization brought to bear on stocks. If hedge funds and other institutional traders continue to enter the market en masse, spreads will be arbitraged away to the point that 1-2 pips (or even smaller!) should become the norm for all major currency pairs.

In short, retail forex traders should applaud the decline in stock prices. After all, what’s good for traders is probably going to be bad for business. Liquidity is increasing, and spreads are falling. Enhanced regulation is eliminating shadowy sources of profit and will make trading more secure. The only thing left to hope for is that all forex brokers go public, and open up their books to the same level of scrutiny as GAIN Capital and FXCM.

Before we jump to conclusions, it’s important to understand the basis for this sudden aura of uncertainty . First of all, both firms – as well as the broader forex industry – have found themselves the subject of increased regulatory scrutiny, and consequent disciplinary action. Second, trading volume has been impacted by an uptick in volatility. Third, an increase in institutional trading volume has not translated into a proportional increase in revenues/profits. Fourth, the recent tightening of leverage rules (which may be helping traders!) has eroded a large profit center. Finally, high account turnover suggests that the brokers will eventually run out of customers.

I don’t want to dwell on the industry’s regulatory travails (since I have blogged about it before), except to say that I think it’s a good thing. It will bring greater transparency, and generally make trading safer and cheaper. For more information on the specific allegations and (potential) regulatory response, the WSJ recently published an excellent overview.

As for the temporary decline in retail trading volume, this is probably temporary. Overall forex volume has tripled over the last decade, and it is forecast to triple again over the coming decade. In addition, the mainstreaming of currency trading will spur millions of investors to at least dabble on forex. Unfortunately, this will probably be offset by a decline in trading activity by existing customers, as the majority come to terms with the difficulty of profiting through high-volume/high-leverage trading.

Furthermore, increased volume will combine with increased competition to facilitate lower spreads. According to a recent report by LeapRate, GAIN Capital now earns an average of only 1.7 pips per trade, a stunning drop for the 2.7 pips that it averaged during most of 2010. Basically, the same thing is now happening to forex that decimalization and computerization brought to bear on stocks. If hedge funds and other institutional traders continue to enter the market en masse, spreads will be arbitraged away to the point that 1-2 pips (or even smaller!) should become the norm for all major currency pairs.

In short, retail forex traders should applaud the decline in stock prices. After all, what’s good for traders is probably going to be bad for business. Liquidity is increasing, and spreads are falling. Enhanced regulation is eliminating shadowy sources of profit and will make trading more secure. The only thing left to hope for is that all forex brokers go public, and open up their books to the same level of scrutiny as GAIN Capital and FXCM.

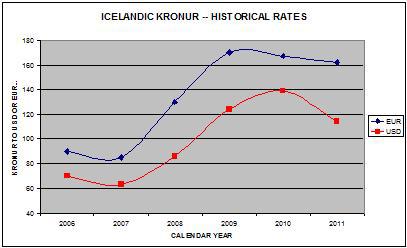

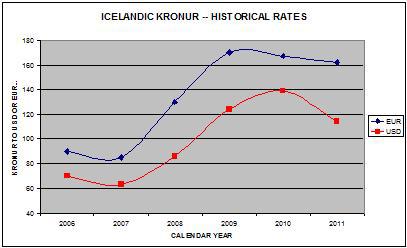

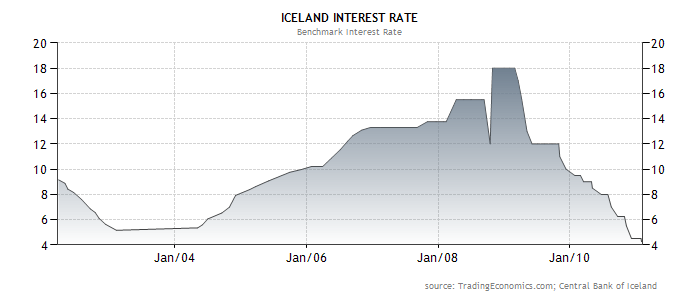

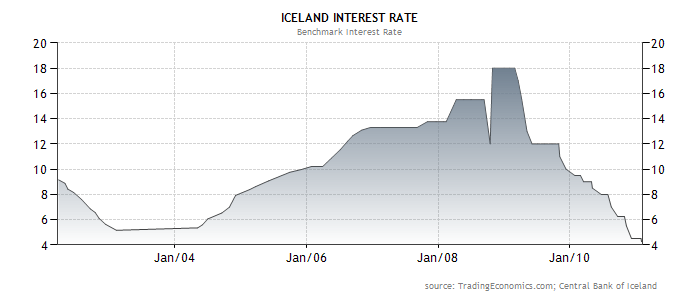

Icelandic Kronur: Lessons from a Failed Carry Trade

A little more than two years ago, the Icelandic Kronur was one of the hottest currencies in the world. Thanks to a benchmark interest rate of 18%, the Kronur had particular appeal for carry traders, who worried not about the inherent risks of such a strategy. Shortly thereafter, the Kronur (as well as Iceland’s economy and banking sector) came crashing down, and many traders were wiped out. Now that a couple of years have passed, it’s probably worth reflecting on this turn of events.

At its peak, nominal GDP was a relatively modest $20 Billion, sandwiched between Nepal and Turkmenistan in the global GDP rankings. Its population is only 300,000, its current account has been mired in persistent deficit, and its Central Bank boasts a mere $8 Billion in foreign exchange reserves. That being the case, why did investors flock to Iceland and not Turkmenistan?

The short answer to that question is interest rates. As I said, Iceland’s benchmark interest rate exceeded 18% at its peak. There are plenty of countries that offered similarly high interest rates, but Iceland was somehow perceived as being more stable. While it didn’t apply to join the European Union (its application is still pending) until last year, Iceland has always benefited from its association with Europe in general, and Scandinavia in particular. Thanks to per capita GDP of $38,000 per person, its reputation as a stable, advanced economy was not unwarranted.

On the other hand, Iceland has always struggled with high inflation, which means its interest rates were never very high in real terms. In addition, the deregulation of its financial sector opened the door for its banks to take huge risks with deposits. Basically, depositors – many from outside the country – parked their savings in Icelandic banks, which turned around and invested the money in high-yield / high-risk ventures. When the credit crisis struck, its banks were quickly wiped out, and the government chose not to follow in the footsteps of other governments and bail them out.

Moreover, it doesn’t look like Iceland will regain its luster any time soon. Its economy has shrunk by 40% over the last two years, and one prominent economist has estimated that it will take 7-10 years for it to fully recover. Unemployment and inflation remain high even though interest rates have been cut to 4.25% – a record low. The Kronur has lost 50% of its value against the Dollar and the Euro, the stock market has been decimated, and the recent decision to not remunerate Dutch and British insurance companies that lost money in Iceland’s crash will only serve to further spook foreign investors. In short, while the Kronur will probably recover some of its value over the next few years (aided by the possibility of joining the Euro), it probably won’t find itself on the radar screens of carry traders anytime soon.In hindsight, Iceland’s economy was an accident waiting to happen, and the global financial crisis only magnified the problem. With Iceland – as well as a dozen other currencies and securities – investors believed they had found the proverbial free lunch. After all, where else could you earn an 18% by putting money in a savings account? Never mind that inflation was just as high; with the Kronur rising, carry traders felt assured that they would make a tidy profit on any funds deposited in Iceland.